Font size:

Print

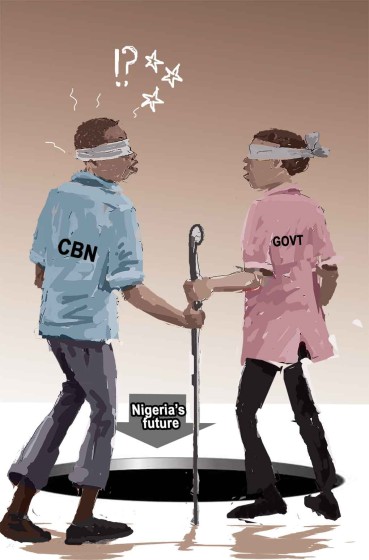

NIGERIANOMICS AND THE BLIND LEADING THE BLIND

By: Sir Henry Olujimi Boyo (Les Leba) first published in August 2016

INTRO:

Last week, this column republished “Cheaper Foreign Loans or Debt Trap?” The article addresses Nigeria’s rising debt profile as well as the decline in investments towards improving the nation’s infrastructure. This republication can be found using the below link.

(See www.betternaijanow.com for this series and more articles by the Late Sir Henry Boyo)

Today’s republication discusses double digit inflation rates and the depreciating impact this has on the purchasing power of earned income and standard of living in Nigeria. It also discusses the impact this has on annual budget rates, as well as on imported goods and raw materials - which affects local businesses and manufacturers, making it difficult for them to operate as the value of the Naira falls in the face of rising prices. This tends to have a domino effect, leading to higher levels of unemployment, and ultimately crippling local industries. Read the article below for more insight.

As you read through the below article taking note of previous events and rates, keep in mind its initial publication (2016).

A seemingly responsible fiscal plan will become unimplementable, in the modern era, if the underlying monetary indices are out of sync with budget projections. Conversely, the stubborn sustenance of appropriate monetary benchmarks for inflation, cost of funds and exchange rate may still rescue the performance of an otherwise bad budget.

For example, if salaries and other incomes double or triple summarily, as happened during the Udoji salary awards of the 70’s, prices will spiral beyond the comfort level of consumers, as ‘too much’ Naira supply chase relatively modest output of goods and services on offer.

However, if inflation rate for example, approaches 20 percent, as in our present predicament, then we would also lose a fifth of the purchasing power of our salaries and incomes. The dwindling purchasing power caused by inflation will invariably erode consumer demand for goods and services, and therefore constrain domestic industrial output, while further investment decisions will ultimately be kept on hold.

Thus, in addition to a significant loss in real income values and deepening social poverty, an unmanageable inflationary spiral will severely challenge the comprehensive implementation of any fiscal plan that does not accommodate the prevailing rate of inflation; for example, the recklessly ambitious 2016 N6tn budget, has become difficult to implement because of reduced revenue and a significant Naira devaluation that has increased local production cost to further spur inflation closer to 20 percent.

For the above reasons, Central Bank management, in successful economies everywhere, are statutorily mandated to sustain strategies that will keep money supply at an equilibrium level that will not push inflation rate beyond, say 3-4 percent, so as to sustain price stability and social harmony.

Similarly, if foreign exchange is in short supply and dollar rations are regularly auctioned while Naira supply is, undeniably, constantly in heavy surplus, the local currency, will invariably depreciate in value, and make all imports (including industrial raw materials) correspondingly more expensive. Unfortunately, the competitiveness of local enterprise will become even more seriously challenged, if CBN’s Monetary Policy Committee chooses to counter inflationary pressures by hiking the rates at which commercial banks borrow from CBN, to as high as the 14-16 percent adopted at the MPC meeting in July 2016.

The preceding narrative hopefully explains the need for best practice management of money supply to protect the economy and avert the disenabling and distortional consequences of inflation spiraling way beyond 4 percent. Clearly, horrendous inflation rates above 20 percent will seriously challenge any attempt to diversify any economy or foster inclusive economic growth and create more jobs. Indeed, the Naira’s purchasing power will become seriously diminished and the N1000 may soon be worth less than a dollar, if inflation remains untamed.

Price stability will also remain elusive and the economy will invariably underperform so long as CBN remains trapped in an unending, very costly battle to remove the systemic threat of surplus Naira from the economy. So, what are the causes of this evidently burdensome systemic excess Naira liquidity, one may ask, and why is CBN failing to wrestle inflation to international best practice rates below, say 4 percent so that our incomes, industries and jobs can be protected?

Instructively, Naira supply will obviously increase if government continuously prints more Naira and borrows heavily without caution to fund its budget, as presently demonstrated in the 2016 budget structure. Furthermore, Naira supply also increases inordinately, whenever government’s forex receipts are directly substituted with fresh Naira supply as allocations, while CBN keeps and unilaterally auctions dollar rations from time to time in a market where excess liquidity undeniably prevails.

Fortunately, CBN also has the alternative option of modulating money supply by establishing appropriate cash levels which banks must retain in relation to their assets. Thus, if banks are mandated to keep only one percent of their reserves as cash, although such a low rate of cash reserves will raise the level of risk, it would, however, provide banks with increased capacity to extend more loans to borrowers to fund both consumer demand and productive activities. Nonetheless, the increase in spending made possible by such loans will inadvertently instigate a mismatch with an inadequate supply of goods and services to further propel the rate of inflation to induce the adverse economic and social consequences earlier discussed.

Consequently, the persistent presence of excess Naira supply and the adverse collateral of spiraling inflation, generally compel the imposition of higher mandatory cash reserve ratios so as to reduce credit liberalization by banks and restrain spending while also consolidating the financial risk cover.

Alternatively, however, the CBN may also resort to borrowing the perceived surplus cash in commercial banks’ custody (this process is described as CBN mopping up of excess liquidity) so as to forestall liberal bank loans which could drive consumer spending and propel higher inflation rates in a market, that is ironically, already burdened by much more cash than output. For example, by December 2015, in anticipation of the persistent obstacle of such overwhelming systemic Naira surplus, the CBN had already concluded that it would mop up (remove) over N6000bn from the systemic cash surplus projected in the 2016 fiscal year, despite the attendant oppressive cost to government. Regrettably, the average interest on such CBN borrowing is about 10 percent; thus, banks and other portfolio investors will earn easy returns of about N600bn for adding absolutely nil value to the economy, from their purchase of government treasury bills. This reality probably explains why banks do not care much about the real sector.

Sadly, the CBN has disturbingly shown more affinity for using the instrument of liquidity mop up, despite the collateral of its crushing national debt burden. On the contrary, an increase in the mandatory cash reserve requirement for all commercial banks, even beyond 70 percent, if necessary, would equally mop up excess liquidity, ironically, at zero cost, and would certainly be a more responsible option. It is unclear why the CBN has always preferred the debt inducing option for mopping up surplus Naira.

Furthermore, it is inexplicable that despite the crying need of the real sector, particularly SMEs, for cheap loanable funds to drive their businesses and create more jobs, CBN’s mop up operations, ironically crowd out the real sector’s access to funds and invariably fires inflation to impede inclusive growth and the creation of more job opportunities.

It is notable that the funds from the projected N6Tn surplus Naira liquidity mop up operations by CBN, cannot be applied to any capital or recurrent expenditure; indeed, such application will be counterproductive, and will simply amount to re-injecting more liquidity into a market, that is already undeniably, seriously encumbered by the subsisting stock of bloated money supply, which can drive inflation beyond everyone’s comfort zone.

Furthermore, the CBN’s MPC recent adoption of 14-16 percent interest rate for its advances to commercial banks will invariably raise cost of borrowing well beyond 20 percent for most businesses. Indeed, this monetary strategy becomes self-flagellation, as the Apex bank inadvertently becomes a victim of higher interest rates whenever it also borrows to remove excess liquidity to restrain spiraling inflation, and its oppressive social and economic consequences.

In conclusion, it is evident that until the paradox of the unceasing burden of excess liquidity is resolved, Nigeria’s economy may not enjoy any respite. Nonetheless, no plausible explanation has been given as the reason why cost of funds should become expensive despite an embarrassingly huge burden of allegedly Excess Naira liquidity. Poor me, I do not yet know of any commodity that becomes increasingly expensive, when it becomes more surplus.

SAVE THE NAIRA, SAVE NIGERIANS!

By: Sir Henry Olujimi Boyo (Les Leba) first published in August 2016

INTRO:

Last week, this column republished “Cheaper Foreign Loans or Debt Trap?” The article addresses Nigeria’s rising debt profile as well as the decline in investments towards improving the nation’s infrastructure. This republication can be found using the below link.

(See www.betternaijanow.com for this series and more articles by the Late Sir Henry Boyo)

Today’s republication discusses double digit inflation rates and the depreciating impact this has on the purchasing power of earned income and standard of living in Nigeria. It also discusses the impact this has on annual budget rates, as well as on imported goods and raw materials - which affects local businesses and manufacturers, making it difficult for them to operate as the value of the Naira falls in the face of rising prices. This tends to have a domino effect, leading to higher levels of unemployment, and ultimately crippling local industries. Read the article below for more insight.

As you read through the below article taking note of previous events and rates, keep in mind its initial publication (2016).

A seemingly responsible fiscal plan will become unimplementable, in the modern era, if the underlying monetary indices are out of sync with budget projections. Conversely, the stubborn sustenance of appropriate monetary benchmarks for inflation, cost of funds and exchange rate may still rescue the performance of an otherwise bad budget.

For example, if salaries and other incomes double or triple summarily, as happened during the Udoji salary awards of the 70’s, prices will spiral beyond the comfort level of consumers, as ‘too much’ Naira supply chase relatively modest output of goods and services on offer.

However, if inflation rate for example, approaches 20 percent, as in our present predicament, then we would also lose a fifth of the purchasing power of our salaries and incomes. The dwindling purchasing power caused by inflation will invariably erode consumer demand for goods and services, and therefore constrain domestic industrial output, while further investment decisions will ultimately be kept on hold.

Thus, in addition to a significant loss in real income values and deepening social poverty, an unmanageable inflationary spiral will severely challenge the comprehensive implementation of any fiscal plan that does not accommodate the prevailing rate of inflation; for example, the recklessly ambitious 2016 N6tn budget, has become difficult to implement because of reduced revenue and a significant Naira devaluation that has increased local production cost to further spur inflation closer to 20 percent.

For the above reasons, Central Bank management, in successful economies everywhere, are statutorily mandated to sustain strategies that will keep money supply at an equilibrium level that will not push inflation rate beyond, say 3-4 percent, so as to sustain price stability and social harmony.

Similarly, if foreign exchange is in short supply and dollar rations are regularly auctioned while Naira supply is, undeniably, constantly in heavy surplus, the local currency, will invariably depreciate in value, and make all imports (including industrial raw materials) correspondingly more expensive. Unfortunately, the competitiveness of local enterprise will become even more seriously challenged, if CBN’s Monetary Policy Committee chooses to counter inflationary pressures by hiking the rates at which commercial banks borrow from CBN, to as high as the 14-16 percent adopted at the MPC meeting in July 2016.

The preceding narrative hopefully explains the need for best practice management of money supply to protect the economy and avert the disenabling and distortional consequences of inflation spiraling way beyond 4 percent. Clearly, horrendous inflation rates above 20 percent will seriously challenge any attempt to diversify any economy or foster inclusive economic growth and create more jobs. Indeed, the Naira’s purchasing power will become seriously diminished and the N1000 may soon be worth less than a dollar, if inflation remains untamed.

Price stability will also remain elusive and the economy will invariably underperform so long as CBN remains trapped in an unending, very costly battle to remove the systemic threat of surplus Naira from the economy. So, what are the causes of this evidently burdensome systemic excess Naira liquidity, one may ask, and why is CBN failing to wrestle inflation to international best practice rates below, say 4 percent so that our incomes, industries and jobs can be protected?

Instructively, Naira supply will obviously increase if government continuously prints more Naira and borrows heavily without caution to fund its budget, as presently demonstrated in the 2016 budget structure. Furthermore, Naira supply also increases inordinately, whenever government’s forex receipts are directly substituted with fresh Naira supply as allocations, while CBN keeps and unilaterally auctions dollar rations from time to time in a market where excess liquidity undeniably prevails.

Fortunately, CBN also has the alternative option of modulating money supply by establishing appropriate cash levels which banks must retain in relation to their assets. Thus, if banks are mandated to keep only one percent of their reserves as cash, although such a low rate of cash reserves will raise the level of risk, it would, however, provide banks with increased capacity to extend more loans to borrowers to fund both consumer demand and productive activities. Nonetheless, the increase in spending made possible by such loans will inadvertently instigate a mismatch with an inadequate supply of goods and services to further propel the rate of inflation to induce the adverse economic and social consequences earlier discussed.

Consequently, the persistent presence of excess Naira supply and the adverse collateral of spiraling inflation, generally compel the imposition of higher mandatory cash reserve ratios so as to reduce credit liberalization by banks and restrain spending while also consolidating the financial risk cover.

Alternatively, however, the CBN may also resort to borrowing the perceived surplus cash in commercial banks’ custody (this process is described as CBN mopping up of excess liquidity) so as to forestall liberal bank loans which could drive consumer spending and propel higher inflation rates in a market, that is ironically, already burdened by much more cash than output. For example, by December 2015, in anticipation of the persistent obstacle of such overwhelming systemic Naira surplus, the CBN had already concluded that it would mop up (remove) over N6000bn from the systemic cash surplus projected in the 2016 fiscal year, despite the attendant oppressive cost to government. Regrettably, the average interest on such CBN borrowing is about 10 percent; thus, banks and other portfolio investors will earn easy returns of about N600bn for adding absolutely nil value to the economy, from their purchase of government treasury bills. This reality probably explains why banks do not care much about the real sector.

Sadly, the CBN has disturbingly shown more affinity for using the instrument of liquidity mop up, despite the collateral of its crushing national debt burden. On the contrary, an increase in the mandatory cash reserve requirement for all commercial banks, even beyond 70 percent, if necessary, would equally mop up excess liquidity, ironically, at zero cost, and would certainly be a more responsible option. It is unclear why the CBN has always preferred the debt inducing option for mopping up surplus Naira.

Furthermore, it is inexplicable that despite the crying need of the real sector, particularly SMEs, for cheap loanable funds to drive their businesses and create more jobs, CBN’s mop up operations, ironically crowd out the real sector’s access to funds and invariably fires inflation to impede inclusive growth and the creation of more job opportunities.

It is notable that the funds from the projected N6Tn surplus Naira liquidity mop up operations by CBN, cannot be applied to any capital or recurrent expenditure; indeed, such application will be counterproductive, and will simply amount to re-injecting more liquidity into a market, that is already undeniably, seriously encumbered by the subsisting stock of bloated money supply, which can drive inflation beyond everyone’s comfort zone.

Furthermore, the CBN’s MPC recent adoption of 14-16 percent interest rate for its advances to commercial banks will invariably raise cost of borrowing well beyond 20 percent for most businesses. Indeed, this monetary strategy becomes self-flagellation, as the Apex bank inadvertently becomes a victim of higher interest rates whenever it also borrows to remove excess liquidity to restrain spiraling inflation, and its oppressive social and economic consequences.

In conclusion, it is evident that until the paradox of the unceasing burden of excess liquidity is resolved, Nigeria’s economy may not enjoy any respite. Nonetheless, no plausible explanation has been given as the reason why cost of funds should become expensive despite an embarrassingly huge burden of allegedly Excess Naira liquidity. Poor me, I do not yet know of any commodity that becomes increasingly expensive, when it becomes more surplus.

SAVE THE NAIRA, SAVE NIGERIANS!