Font size:

Print

STATE, LG SPENDINGS WRECK ECONOMY – SOLUDO

BY: LES LEBA (Email: lesleba@yahoo.com)

Website: www.betternaijanow.com

“States and Local Governments’ unrestrained expenditure pattern is making effective management of the national economy difficult.” The Central Bank of Nigeria (CBN) Governor, Prof. Charles Soludo has said!

The title of this article and the above paragraph come from a front page report of the Vanguard Newspaper of Monday, 17th August 2006. The CBN Governor made the above indictment at the Justice Kayode Esho Lecture at the Obafemi Awolowo University Ile Ife earlier this month and lamented that “if all revenues accruing to the federation account are shared among all tiers of government and each with statutory right to spend irrespective of the economic implications, then the federal government has very little control over fiscal policy. The monetary policy implications of such a regime are also complicated!”

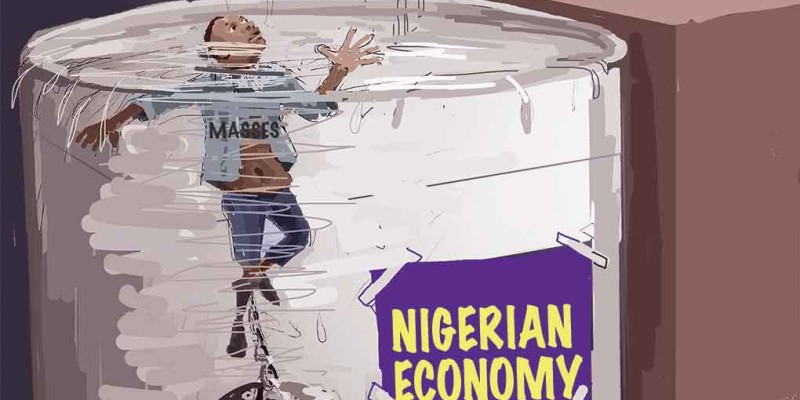

A literal interpretation of the above statement, is that our eminent Professor is totally helpless in his position as the Governor of our Central Bank in creating an enabling economic environment that would promote development and alleviate the pains of majority of Nigerians who live on less than $1 a day, because his otherwise exalted office does not have the power to control how the states and local governments choose to spend the moneys allocated to them from the federation account.

If this is a true expression of Soludo’s nightmare, then, discerning Nigerians will be astonished and truly concerned at the incumbent Governor’s grasp of the fundamentals of his watch! Central Banks all over the world have at their disposals, certain instruments of control, the appropriate application and synchronization of which should bring about a desirable economic ambience in the face of eternally limited resources. The prime instrument in the arsenal of central banks worldwide is the level of interest rate for the ‘forced’ borrowings of the local commercial banks from each country’s Central Bank. The commercial banks’ lending rates (both for consumption and investment spending) take a cue from each country’s central bank rate. In Nigeria, this central rate is called the Minimum Rediscount Rate (MRR) and it currently costs any commercial bank which requires a bridging gap to maintain it statutory cash ratios in the face of pressing demands, 14% to borrow from the CBN. In America, this rate is called the Federal Reserve Rate and in the UK, it is called the Bank of England Rate. In both countries, and indeed, in economically and industrially progressive nations, such rates usually fall below 5%; until a few months back, Japan’s rate was 0%! In contrast, Nigeria’s rate is about 200% higher!

The consequence of our oppressive MRR is that businesses borrow from the banks at over 20%, aside of various other arbitrary charges, which would be loaded to an already high interest rate burden. Thus, overseas businesses have a better chance of survival as they would generally access loans from their own banks at below 8% and are capable of producing industrial and consumer goods for export after satisfying local demand. On our side in Nigeria, the fear of a bank’s high interest rate is the beginning of wisdom, as it requires near magical powers to borrow at 20%+ rates of interest for industrial projects with usually delayed gestations of up to two years. Even where daredevil Nigerian risk takers access such loans, the products of their enterprise become more expensive than imported counterparts which are produced with considerably reduced interest burden and with enabling ambient infrastructure in contrast to the Nigerian counterpart. The result of this skewed imbalance is the carcasses of industrial establishments which have been converted to worship centres and the huge mass of unemployed Nigerians all over the country.

The simple lesson is that you cannot grow a country’s economy with over 10% commercial lending rates. Professor Soludo should be so kind as to tell Nigerians, which country in the world has succeeded in controlling spiraling inflation and grown their economy with its Central Bank’s control rate at 14% and commercial lending rates above 20%. Nigerians would also be interested in further education on how our monetary gurus can sincerely expect a buoyant economy when the government competes with the real sector for the available funds in the money market by paying up to 17% for borrowings made by the government through the sale of bonds. Why would any rational banker look the way of industry or the income and employment generating opportunities of investing in the real sector when they can make 17% from safe, guaranteed, risk-free investments in government securities?

In a separate but related intriguing development, the Daily Independent of Thursday, 18/8/06 in a caption titled “Soludo Declares 10% Growth Rate a Mirage” the Chairman of the Monetary Policy Committee, MPC, also lamented that “…the CBN has so far spent N78 billion since the beginning of this year to keep monetary operations in check and inflation at desirable level” and warned that “…this might grow more if expansionary tendency of government continues before the end of the year”. Nigerians have every cause to worry about this statement, coming from the top dog of the body who controls our economic destiny. Pray, how do you control government expenditure and keep inflation in check by further spending N78bn within six months? Please, Mr. Governor, tell us a little bit more about this magic and indicate what this huge sum was spent on! The stark reality of our abiding inflationary spiral and our unyielding economic climate are clear indications that the $78bn so far spent have not achieved its purpose.

The truth is that Prof. Soludo has exposed his limited capacity as the Chairman of our nation’s treasury. This inadequacy is further graphically demonstrated by the inability of the government’s ‘acclaimed’ economic team to translate the expected bountiful benefits from our current huge oil endowments of over $38bn reserves to the benefit of long suffering Nigerians. Even a ‘blind’ man can feel the adverse impacts of the infrastructural deficiencies in all states and local governments in the country, especially in the critical areas of education, health, power, water, etc; meanwhile, our national economic team are lamenting the expansionary expenditure pattern of government. If governments have to restrain spending under this scenario, how do you create more jobs, and improve the welfare of millions of impoverished masses?

It would not serve Prof. Soludo’s purpose to continue chasing shadows and blaming his glaring failures on his lack of power to control how the states and local governments spend their money! The Federal Reserve and the Bank of England do not tell their constituent states and local counties, respectively how they spend their money. These agencies of state naturally respond to the instruments of monetary control, particularly the Central Bank’s control rate; it would be predictable economic suicide if they refuse to recognize their central bank’s writings on the wall at all times! Soludo cannot hide his failures under his own specially designed cloak of basic economic principles, as more and more Nigerians have begun to see that he is actually dancing naked! With a little sincerity, Prof. Soludo will agree that the nucleus of our economic predicament is the monthly unilateral conversion of our export dollar revenue into naira before sharing to the three-tiers of government!

SAVE THE NAIRA, SAVE NIGERIANS!