ECONOMY: MORE QUESTIONS THAN ANSWERS!

By: Sir Henry Olujimi Boyo (Les Leba) first published in August 2006

INTRO:

Last week, this column republished “Economic Renewal: Questions and Answers” This article was written by The Late Sir Henry Boyo in interview-style format to engage readers of the Rational Perspectives column on Nigeria’s economic climate. All republications can be found in the archives using the below link.

(See www.betternaijanow.com for this series and more articles by the Late Sir Henry Boyo)

Today’s republication is also depicted in interview-style format in order to efficiently discuss the intricate workings of the Nigerian economy. The Late author poses clear questions that should be asked for readers to gain a better understanding of the unchanging issues faced by Nigerians, and how best these issues should be managed. Although the article was first published in 2006, its relevance stands due to the unfortunate reality that the Nigerian economy has consistently declined since.

As you read through the below article taking note of previous events and rates, keep in mind its initial publication (2006).

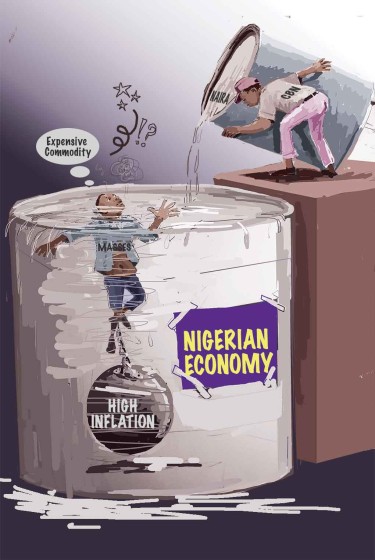

In a further attempt to enlighten some of the readers of this column, this week’s article will throw up questions and contradictions between causes and effects in the current framework of economic and monetary policies adopted by the government’s economic team, especially with regard to the scourge of too much money or so-called excess liquidity in the system. Please read on.

1. (a) How Does Our Own Brand of Perennial Excess Liquidity Come About?

The question of perennial excess liquidity arises every month when the CBN pumps huge sums, often in excess of N300bn into the bank accounts of the three tiers of government.

(b) What is the Effect of This Injection?

In this event, the cash positions of the banks are greatly enhanced and their capacity to extend credit would exceed N1 trillion. Meanwhile, a credit expansion of such magnitude would trigger an inflationary spiral, since the cash is not directly backed by any productivity. The CBN attempts to reduce the lending capacity of the banks by rushing to the money market to sell treasury bills and bonds and collect cash, which is simply sterilized, according to the CBN Governor in media reports! But pray, why would anyone in his correct senses borrow at over 12% per annum, just to simply sterilize the money raised? Meanwhile, the CBN could have addressed the issue of excess liquidity at no cost whatsoever to Nigerians by increasing the cash reserve ratio of the banks!

(c) Cash Sterilization in the Face of Decrepit Infrastructure

The fear is that the sterilized funds raised from treasury bills and bonds would only exacerbate the problem of liquidity if these funds are re-injected for the purpose of repairing our leaking roofs!! A catch 22 scenario, you might say!

2. Why Must We Borrow at 12% and 17% When We Have Idle Reserves?

As you know, our reserves abroad earn probably less than 3% interest. Meanwhile, we continue to borrow funds at such high rates locally and then turn round and simply sequester the funds raised from Treasury bills and bonds. It would require a magician to convince rational Nigerians of the wisdom in this exercise.

3. Why Must CBN Set MRR so High at 14%?

This is CBN’s way of discouraging consumer lending by the banks. The CBN cannot bring down Minimum Rediscount Rate, MRR (i.e., commercial lending control rate) so that lending rates will fall to single digit investment friendly rates because they want to discourage consumption lending. Unfortunately, the high lending rates also cripple capacity building in the real sector as no meaningful industrial development and expansion can carry a burden of over 20% for borrowed funds, especially in view of the long gestation periods for industrial projects. As expected, banks prefer the risk-free government borrowings with high returns than lending to the less predictable real sector!

Sale of Official Dollar Revenue to Bureau De Change

Now, who patronize the BDCs? These are certainly, predominantly, smugglers of banned items, treasury looters, and other persons who do not possess formal documentation to access official foreign exchange through the banks. Now the CBN policy to sell $400,000 to every BDC every week translates to $1.6bn, if there are 1000 BDCs, every month!

Meanwhile, overseas manufacturers of consumer goods enjoy 5-6% interest burden and have more supportive infrastructure, and generally a better trained labour force. So, how can our local manufacturers compete? Indeed, a cheaper BDC dollar means cheaper smuggled goods and a boon to looters of the treasury, as they will get more dollars for their naira and the greater the distress caused to local industries.

The real sector does not patronize the BDCs for their dollar requirements and as such, the emphasis should have been on significantly improving the value of the naira in the official market, so that bona fide manufacturers can bring in their raw materials more cheaply and fund their retooling and machinery imports much more easily.

In spite of the fact that we don’t know the sustainability of current record oil earnings, it is surprising that we are willing to throw more official dollar revenue to the BDCs, rather than the real sector, and it is worrisome that no less a person than the CBN Governor has boasted at various media briefings that our reserves are healthy enough for us to embark on such a foolish escapade! It is sadly reminiscent of reports of Gen. Gowon’s boast that money is not our problem, but how to spend it!

Naira Rate of N50=$1

A rate of N50=$1 would significantly reduce raw materials and machinery costs, including the cost of diesel and petrol, which would fall to less than N40/litre and enhance profitability of small and medium scale industries and reduce the burden on motorists, and the general price level. The opinion that a strong naira would reduce the viability of our exports is a fallacy! Apart from oil, we do not currently have any viable major export products. Over the years, weak naira has obviously failed to stimulate production for export! Meanwhile, a stronger naira will generally reduce cost of goods to the domestic market and God knows that we have a huge domestic market to satisfy, as most developed countries see our market as the destination for their exports because of our huge demand base. We have not satisfied the domestic market; we are talking about export under the prevailing unfriendly investment conditions. What false hopes! Meanwhile, the naira rate could consolidate to less than N50=$1, if the huge allocations of over N300bn is not pushed into the banks to provide excess naira chasing dollars every month!

Drawing Down Our Reserves

The quest for foreign loans, when the costs of such loans exceed the interest payments on our reserves abroad is absurd. Indeed, with the current prospect of the dollar falling against the euro, it makes more sense to take value for most of our reserves and apply them directly to critical areas of need that will enhance both the human and industrial capacity building that would provide the appropriate platform for our industrial take off and significantly reduce unemployment!

It makes no sense to choose to distribute part of our reserves to some Nigerian banks who are at liberty to invest them elsewhere other than to improve our own industrial development; it is worse still to have paved the way with recent changes in CBN monetary policy for these banks to recycle the funds to naira and invest them in the treasury bills and bonds market and make returns of 12-17% respectively while they in turn pay less than 5% on the Nigerian foreign reserves in their care.

Solution to Contradictions

The solution to the seemingly intractable contradictions above has been amplified in a paper titled: "A LIBERALIZED FOREIGN EXCHANGE MARKET: a proposal for a liberalized foreign exchange market in Nigeria and its economic benefits".

The summary of that paper is that the adoption of dollar certificates for settlement of the dollar component of the monthly federal distributable revenue would be a more economics compliant way of moving our country forward.

Save the Naira, Save Nigerians!