WILL ANY OF THE CURRENT POLITICAL PARTIES RESCUE THE ECONOMY?

By: Sir Henry Olujimi Boyo (Les Leba) republished in March 2015

INTRO:

Last week, this column republished “Party Campaigns and the Phobia of True Federalism” It questions the underlying motivations of party candidates in the face of failing infrastructure, increasing levels of unemployment, etc. All republications can be found in the archives using the below link.

(See www.betternaijanow.com for this series and more articles by the Late Sir Henry Boyo)

Today’s republication refers to the 2015 elections as a reminder that if Nigeria is to forge ahead, then it is crucial that the ruling party is willing and able to address key issues that have kept the nation shackled for decades. It pinpoints excess money supply as the main deterrent towards economic progress, and the lack of knowledge of government officials regarding the economy. It provides effective rationale on this stance and further explains that until the issue of money supply is addressed by leadership that understands the workings of the economy, all promises made will remain empty.

As you read through the below article taking note of previous events and rates, keep in mind its first republication (2015), a clear indication that things remain stagnant even as we face the year 2023.

The 2015 election was barely two weeks away and yet, not even close followers of events in the political space can satisfactorily articulate distinctive differences in the ideology of the two major contestants. Instead, Nigerians were fêted to a reality edition of an otherwise Nollywood dramatization of a “roforofo fight” between two wives in a polygamous setting. Ironically, the protagonists expect the favoured husband to make the louder and less civil combatant his favorite! However, since both wives also carry the same excess baggage of an uncomplimentary heritage, the choice of a favourite wife, who would judiciously manage the family resources for the next 4 years, for the greater good, has become a monumental challenge for the poor electorate. Fast forward to 2023, we have 4 major contestants and four major political parties; applying the above analogy in today’s current circumstances, we ironically face the same predicament!

Similarly, history has it that judicious management of resources positively transforms economies, whenever such nations adopt economic and political systems, which induce competitive entrepreneurial spirit and also encourage self-reliance. For example, the imposition of ‘unitary federalism’ which predicates our association as a nation, has obviously failed to serve as an engine of inclusive economic growth; sadly, despite the available lean resources before the advent of dictatorship in 1966, the strident economic progress and keenly competitive enterprise of existing Regional Governments, has clearly become unachievable despite the huge leap in revenue under the present arrangement of ‘unitary federalism’.

Our stunted federalism will ultimately sink the liberally patched ship of state to bring untold anguish to millions of our countrymen. Nonetheless, any movement towards the political equity in traditional federalism, would clearly reduce the fatal attraction to control the resource rich centre and will ultimately also enthrone an enduring political structure that would bring out the best in us, as in the glorious years of regional autonomy. However, such positive transformation will not serve the interest of the political class who derive stupendous benefits from the prevailing skewed social contract.

Furthermore, the 36/7-state political structure is clearly a great disservice to Nigerians. This selfish contraption has supported incredible duplication of functions and wastage of scarce resources, such that there is a need to borrow to supplement, even consumption expenses, that now account for over 80% of projected total federal spending in 2015.

Regrettably, none of the major parties is in any hurry to tell us how they intend to redress expenditure in favor of infrastructure and human capacity building, and no one is demanding to know those specific areas which would suffer revenue cuts from any such fiscal discipline; sadly, in spite of over 100 million Nigerians living in abject poverty, the salaries of our lawmakers are reported to probably be the highest anywhere in the world and over 100 times the national minimum wage. Nonetheless, politicians of all hues whether PDP, NNPP, LP or APC will certainly reject any attempt to realign their gross emoluments with reality, even if such alignment will provide economic succor to those impoverished electorates who voted them into office.

Furthermore, the accumulated debts politicians incurred during the extended campaign trail have to be repaid, with a handsome profit while successful political officeholders have barely 4 years to acquire enough wealth to last a lifetime.

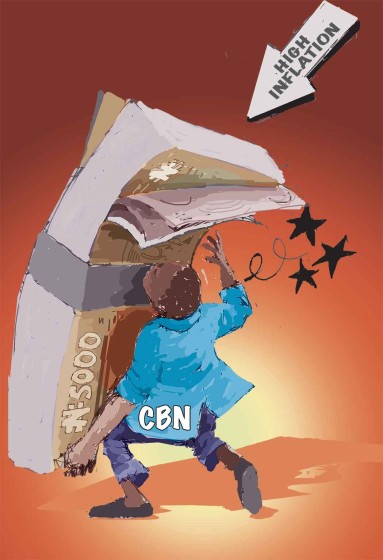

Clearly, neither the ruling nor the main opposition party has a clear grasp of how an economy works; consequently, they do not quite understand the critical significance of the impact of excessive money supply in an economy. Indeed, with the existing systemic bloated disequilibrium in money supply, any hope or talk of industrial growth, increasing employment opportunities, increasing consumer demand, reduced debt burden, fuel subsidy abolition and new refineries or indeed any promise to diversify the economy would remain just hot air, as already faithfully demonstrated by failed serial attempts by successive administrations to bring about socially and economically supportive outcomes.

Invariably, the success or failure of any economy clearly rests on the best practice management of money supply, such that inflation would remain below 3% to protect mass social welfare and consumer demand which drives industrial growth. Similarly, discipline in the management of money supply will modulate interest rates in line with the aspirations of the needs of an economy, but, clearly no economy can achieve distinctive growth or economic diversification if, in addition to the burden of oppressive energy costs as an abiding albatross against their survival, industrialists, commercialists and other stakeholders in the small and medium Enterprise subsector have to borrow at over 20% to fund their operations.

So it is necessary that the current political parties should educate the electorate on how, in the face of, systemic excess money supply, they would bring down inflation to below 3% or how, they expect interest rates to fall below 7% across the board to liberalize cheap funding (as opposed to selective preferential sectorial packages) for serious business people to increase production and create more jobs.

It is foolhardy to continue to accumulate national debt in the belief that the current debt to GDP ratio is within tolerable limits. Inexplicably, the high cost of funds instigated by CBN’s 13% MPR (in place of less than 2% in successful economies) makes it inevitable that government’s domestic borrowings will also attract abnormally high interest rates, which are clearly inappropriate for such sovereign risk-free loans.

Total domestic debts are currently reported to be about $40bn, while external debt is about$10bn; it is not clear if the current political leaders actually understand how these escalating debts come about, nonetheless, future generations will continue to bear the burden of debt service with over 20% of current annual budget (about $5bn) for several decades to come. Conversely, if government reduces the cost of its debts and the rate of debt accumulation, it would most likely work against the interest of the cabal and oligarchs that currently control the commanding heights of our economy. These Political parties certainly enjoy support from the beneficiaries of such government profligacy and it may be self-destructive, therefore, to promote any transformation that would ultimately jeopardize the interest of major financiers of any ruling party.

Similarly, political party finances are handsomely supplemented from the substantial fiscal leakages that fund corruption from the deliberate mismanagement of public funds with slap on the wrist sanctions on discovery. The fraudulent opportunities for corrupt enrichment in the fuel/kerosene subsidy scheme currently cost the federal treasury about N1000bn annually and also falls into the category of leakages that reinforce party strength and solidarity, and so any attempt at fiscal discipline maybe akin to the parties’ cutting their nose to spite their face. Similarly, despite the distortion caused by Naira depreciation, the attendant opportunity for rent seeking will prevent any serious attempt to save the Naira.

SAVE THE NAIRA, SAVE NIGERIANS!!!