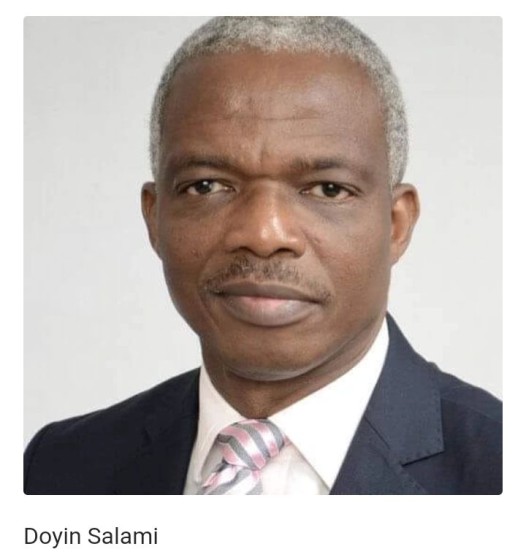

President Muhammadu Buhari has appointed Dr Doyin Salami, his Chief Economic Adviser. Salami, 59, has been serving as Chairman of the Presidential Economic Advisory Council (PEAC). A 1989 doctorate degree graduate in Economics of Queen Mary College, University of London, Doyin Salami, is Managing Director and Head Markets Practice at KAINOS Edge Consulting Limited. He is a member of the Adjunct Faculty at the Lagos Business School (LBS), Pan-Atlantic University, where he recently attained the rank of Senior Fellow/Associate Professor. The Chief Economic Adviser to the President is expected to address all issues on the domestic economy and present views on them to the President. He will also closely monitor national and international developments, trends and develop appropriate policy responses.

According to a statement by media adviser, Femi Adesina, Salami will develop and recommend to the President national economic policies to foster macro-economic stability, promote growth, create jobs, and eradicate poverty, among others. At present, Buhari has a special economic adviser, Adeyemi Dipeolu who works in the Vice President's office. Dipeolu was appointed in 2015.