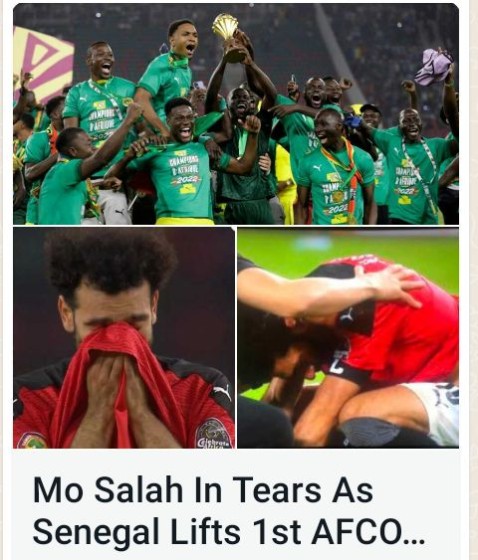

Senegal have won the 2021 Africa Cup of Nations after a penalty shootout victory over Egypt. After both sides scored their first penalties, Mohamed Abdelmonem hit the post with Egypt's second, but Egypt goalkeeper Gabaski then saved from a poor effort from Bouna Sarr. Both sides scored their next penalties, before Edouard Mendy saved a tame spot-kick from Mohamed Lasheen. Sadio Mane then stepped up for Egypt — having already seen a penalty saved by Gabaski in normal time — and made no mistake as he secured Senegal's first-ever Africa Cup of Nations win. Mane's Liverpool teammate Mohamed Salah did not get the chance to take a penalty, with Senegal winning 4-3.

The game's best chance in the opening 90 minutes fell to Mane, but the Liverpool forward missed his seventh-minute spot-kick after Saliou Ciss was fouled in the box. Mane's penalty was poor in truth, as his blasted effort lacked accuracy and was saved by Gabaski. Senegal dominated the ball for most of the match, with Egypt restricted to the occasional counter-attack. Salah struggled to get a foothold in the contest, but did draw a superb save from Mendy mid-way through the first half with a left-footed effort that looked to heading into the top left corner. The second half was mired with tactical fouls, as both sides failed to create any real chances. Gabaski was again called upon to deny Mane, as he smothered a loose ball in the box just as the Senegal man looked to pounce.

Senegal substitute Bamba Dieng had a good chance to open to the scoring at the start of extra-time, but his shot under pressure was saved by Gabaski. It was Egypt's fourth extra-time game of the tournament, after they failed to beat Cameroon, Morocco and Ivory Coast in normal time.from eagle