Font size:

Print

PALI-KINI? WHAT PALLIATIVES?

BY: LLES LEBA (Email: llesleba@hotmail.com)

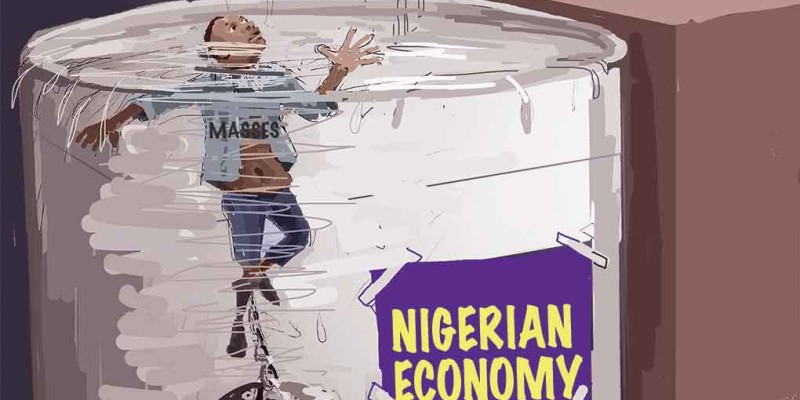

The continuous rise in the prices of petroleum products has unleashed untold hardship on the masses throughout the length and breadth of our country. The fact has become self-evident that the cost of transportation and the prices of food and other essential consumer goods and services also take an immediate cue from rising fuel prices.

In recognition of this fact, the government has responded to the cries of the masses for an amelioration of their helpless conditions by promising to provide relief by way of soft loans and advances directly from the federation pool to either state or private operators to bring in commercial buses for distribution to all thirty-six states in the federation. The expectation is that transport costs would be reduced if the loan beneficiaries are not encumbered with suicidal interest rates burden in excess of 25% per annum. The total amount set aside to relieve the poverty of about 150 million Nigerians is just in excess of N11 billion or $80 million at today’s exchange rate of about N133 = $; (in other words, N70/person or 50 US cents/person as a one-off subsidy)!

The obvious questions on every one’s lips of course, are whether or not this palliative proposed by government is adequate and indeed whether or not the option of palliatives in this context is appropriate. We should attempt to examine both questions in the remainder of this piece. In the process, we will not go into the issues of the constitutionality of the federal government’s unilateral decision (without recourse to the National Assembly) to ‘embellish’ the provisions of the constitution with regard to the sharing of the revenue in the federation pool.

N11.1 BILLION, HOW ADEQUATE?

Simply stated arithmetically, the proposal of government would allocate the sum of N70.00 (seventy naira) to each of about 150 million Nigerians to soften the impact of the poverty punches unleashed by the rising fuel prices. No doubt, most Nigerians would not be impressed and would still feel nakedly exposed to the ravages of increased transport costs, food prices and higher rents, especially in view of over N34 billion gulped by the Abuja Stadium and another N54 billion currently proposed for an Abuja Cultural Centre to serve less than a million people in that city.

Fortunately, ‘the palliative sum’ of N11.1 billion will not be shared in Father Xmas fashion to every living Nigerian. It is clear that this would amount to a meaningless and wasteful application of scarce resources.

The proposed option of the provision of commercial buses to ease and reduce transportation costs certainly has greater merit than the one time donation of N70 pro rata to all Nigerians (wherever they may live)! However, a closer scrutiny of the commercial buses option would give a clearer indication of whether or not the objective of facilitating an enduring public transport system and capping the upward inflationary pressure brought about by rising fuel prices can be achieved.

11.1 BILLION INTEREST FREE LOANS FOR BUSES

Although some states in the federation have raised objections on the constitutionality of the federal governments unilateral disbursement of the federal pool in this regard, some states have rejected the proposal that the funds be spent on the purchase of commercial buses and others have maintained that the type of vehicles proposed were not suitable for their peculiar circumstances. Some other states have expressed their desire to allocate the funds to other pressing priority needs of their states. What is clear in the whole scenario is that the federal government may not have availed itself of the benefits of consultation with stakeholders, including the NLC before a decision on mode and value of palliatives was taken.

$80 MILLION DISBURSEMENT MECHANISM!

The federal government has indicated that the sum of $80 million (N11.1 billion) would be obtained from the additional (not excess as excess would imply over and above defined requirement!) revenue accruing from the unexpected higher international price of crude oil in the recent past. In other words, this revenue which is received in foreign currency (currently dollars) will first be exchanged into naira and subsequently paid into the accounts of beneficiaries of the federation pool. Currently, only the CBN and possibly the Presidency are aware of the exchange rate which the CBN adopts when converting foreign exchange revenue into naira before sharing to beneficiaries of the federation pool. The CBN trading results for 2002 (where the CBN made a profit of N200 billion on forex ) strongly indicate that a difference of up to 30 per cent may exist between the rate adopted by the CBN for converting foreign exchange in the distributable pool and the rate the CBN subsequently sells the dollar through the Dutch Auction System.

In other words, the total number of buses which will be purchased with N11.1 billion can vary by up to 30 per cent depending on the rate of exchange applied by the CBN in converting the foreign exchange value allocated for the palliative measure into naira!

Furthermore, the need to convert the dollar earnings into naira also means that the naira equivalent has to be sought. The CBN would need to print the naira and/or borrow back government funds in the capital market with interest rates of 17 per cent for risk-free borrowing, and or sell some of the dollar to raise the naira amount required for meeting the cost of the palliatives! The truth is that all three modes of finding naira cover for the dollars to be disbursed will create excess liquidity, low value naira and high interest rates in the economy; those factors which have adverse inflationary and distortionary impacts on the smooth operation of economic and monetary policy in Nigeria.

PALLIATIVE ‘BUSES’ AND TRANSPORT COSTS

The federal government has obviously anchored its palliative structure on the reduction of the cost of importation of these buses through interest-free loans! The government is, however, silent on the issue of the cost of operation of these buses on arrival and delivery to recipients. These buses will have to be fuelled to operate; meanwhile, the government is yet unable to put a lid on rising fuel prices locally. Thus even though the recipient of government largesse in the form of interest-free loans for the buses may be able to pay back without much stress, the same can not be said for the masses who will be passengers in these buses and who will have to pay transport fares which are driven by rising fuel prices! So, until the appropriate solution is found to the continuous downward slide of the naira and the concomitant rising price of fuel, the sole beneficiaries of the government palliatives would be political godfathers and party errand boys, who would eventually be allocated with the buses. This type of political patronage would ensure that professional transporters may not even be involved in the project and the survival span of the ‘palliative buses’ project may be very short indeed!

Furthermore, the focus of the government on only commercial buses in its palliative programme appears to be misguided. Commercial buses are good for mass transportation, but the movement of food stuff from the farms to urban centres is generally conducted with lorries and articulated vehicles. It is clear that this very important category of transporters may not benefit from the interest free loans to be advanced to private or state operators from the palliative fund. In this wise, the palliative measures are unlikely to restrain food prices from rising with crude oil prices and a depreciating naira.

In any event, the government may have been better advised to consult with the Nigerian Auto Manufacturers Association to examine alternative ways of spending the N11.1 billion palliative fund. At a time that government is eager to resuscitate industry and improve the abysmal level of employment in the country, it seems odd that we should pursue a course which supports employment in foreign lands and further depletes our foreign exchange reserves.