Font size:

Print

“This article was first published in this column on 28th February 2005; however, the kindled interest on the subject of National Debt Burden generated by the declarations of both the President and House of Representatives on repudiation and the demand of some of our readers make a case for a second outing of this article in this week’s edition of Rational Perspectives. The alarming news that the debt burden has since risen to $37.5 billion from the earlier figure of $34.5 should be a wake up call for urgent action to stop our descent into slavery. We invite comments from our readers on the way out! Please read on!”

The National external debt has reached its highest level ever and is currently advertised to exceed $34 billion by the Federal Government Debt Management Office. Indeed, the DMO Chief Executive has at various times expressed grave concern at the unyielding debt level, but regrettably, no real solutions have been canvassed for addressing the serious debt problem which hangs like a yoke on hapless Nigerians.

A debt burden is an indispensable instrument for corporate growth in modern enterprise when the initial loan has been diligently applied to support the realization of corporate goals of expansion, productivity, profitability and growth. In the case of a nation state, loans correctly applied in strategic areas of need could provide salutary benefits for the people for many years into the future. In this manner, loans could be applied in the development of health, educational, transportation, agricultural and industrial infrastructures to support improved welfare for the populace. The burden of repayment of a loan which has been properly and diligently applied is often bearable as the achievement of the purpose of the loans would facilitate and lessen the burden of payment of interest and repayment of the capital sum.

THE DEBT TRAP

The national debt burden of $34b does not seem to fit into the above category, and the burden is made worse by the public notion that a substantial part of the debt is bogus, despite assurances from the Debt Management Office that all external debts that make up our debt burden have been scrupulously verified. The doubts may not be unconnected with perceived doublespeak of government on various policy matters! Our national landscape is littered with carcasses of failed projects on which colossal amounts of foreign loans have been sunk. The absence of any form of punishment for the major perpetrators of the rape has further deepened the despair and disbelief of most Nigerians. In this event, it would be more useful to examine how we can mitigate the damage already caused so that our children do not become enslaved to our creditors forever! The national debt burden has increased by over 50% in less than 10 years. At this rate of growth, we could owe almost $100 billion in 20 years and the capital sum may never be repaid, if only $2 billion is allocated to debt servicing annually. In other words, despite our payment, our debt burden would continue to increase even if we do not take fresh loans! A veritable debt trap!!

The question then is how do we get out of this debt trap? The external debt consists of both public and private sector borrowings. In general terms, public sector borrowings usually attract less interest charges than private loans and the interest could vary at between 1-3%. Private sector debts may on the other hand attract rates of over 8% depending on the source of funds. Now, if public or private sector loans are not repaid as and when due, these loans would attract higher penalty rates which tend to snowball the debt burden rather quickly. The DMO has indicated that about a third of our national debt of $34 currently attract rather high penalty rates and consequently our annual debt service payment of just about $2 billion only scratches the surface and does not get us out of the penalty rate jail!

DEBT FORGIVENESS AND $20 BILLION NON INTEREST YIELDING RESERVE

The dismal reality above predicates President Obasanjo’s leadership of an African crusade for debt forgiveness. The President expects that Nigeria should be a beneficiary of at least 10% of the total debt cancellation (i.e. $20 billion) being sought. In the unlikely event that external creditors accede to the pleas of Highly Indebted Poor Countries (HIPC), Nigeria’s debt may be whittled down after much begging by $2 billion; but we have seen that this value does not even address the problem of high penalty rates imposed on almost $13 billion of our debt portfolio. In other words, we may get a little breath of fresh air but in real terms, we will still remain in jail.

Nigeria’s advocacy for inclusion amongst the HIPC appears odd in view of our idle reserves to the tune of almost $20 billion the highest reserve base in Africa! We have put aside our dignity and gone cap-in-hand to creditor nations with our Finance Minister wailing in front of the world media for the plight of Nigeria’s debt burden to be seen as comparable to the unfortunate victims of the Tsunami that hit South East Asian countries late last year! A comparison that was most unfortunate and distasteful in style and context. For crying out loud, the Tsunami was a natural unavoidable disaster. On the other hand, our leaders continue to openly impoverish our country through unbridled corruption and self serving and contradictory policies!

On a personal level, we are reminded of the adage that “he who goes a borrowing, goes a sorrowing”. In reality, there is a negative perception of a borrower who begs to be seen as poor in order to attract forgiveness and additional loans! Indeed, creditors would shy away from such poor debtors and if debt forgiveness is remotely considered, the poor debtor may become encumbered forever, and may readily mortgage the future of unborn generations to its shylock creditors. It would also be considered a big joke if a self-acclaimed poor debtor in the same breath canvasses for admission into a security club or council constituted by its patrons or creditors.

On the other hand, a potential borrower, though already highly indebted, but with great potential in terms of resources and an abiding supreme confidence, will have her requests more readily entertained and even wooed by a bevy of ever-ready creditors! The examples of the United States, and most developed nations including Israel, who currently carry huge debt values which make the Nigerian debt level seem like peanuts are relevant in this analysis. In spite of the much, much bigger indebtedness of these countries, creditors remain at their beck and call and are always ready to make further advances to these countries to enable them remain buoyant and capable of repayments of earlier loans. The issue of penalties for payment defaults will usually be sympathetically handled to ensure that a creditor does not fall out of favour with such countries!

THE WAY OUT?

So, the choice is ours, whether in spite of the considerable resources and reserves, we want to be perceived as an HIPC or a potentially vibrant nation that would continue to attract direct foreign investment in spite of a rising debt profile! The requirement is quite clear if we choose the latter option. We would need to immediately clear about $13 billion component of our debt that attracts high penalty interest rates as a result of payments default in the past. This may be achieved in one or two ways. Firstly, we could examine ways of a buy-out of the $13 billion debt component by new and supportive investors from elsewhere; e.g. Middle East, Asia or China who would subsequently earn interest on this sum at lower standard international rates of between 1-3%. Indeed, our new creditors can be assured of scheduled repayments if necessary by crude oil supply arrangement over time at agreed price limits. Although the debt burden will remain at $34 billion, we would free ourselves of excruciating penalty rates!

A second and possibly easier and quicker option would be to immediately clear the $13 billion default component from our current huge reserve of about $20 billion. This would still leave us in the comfortable possession of over three months cover for our import bills; a safe level as per the West African Monetary Zone Standards. No doubt, the reserves will still quickly swell over the next six months to the earlier surplus level since there appears no indication that the current price of around $48/barrel of crude will dip drastically in 2005. Nigeria will immediately be released from the poverty trap and become a beautiful bride for foreign investment in place of almost total dependence on direct loans.

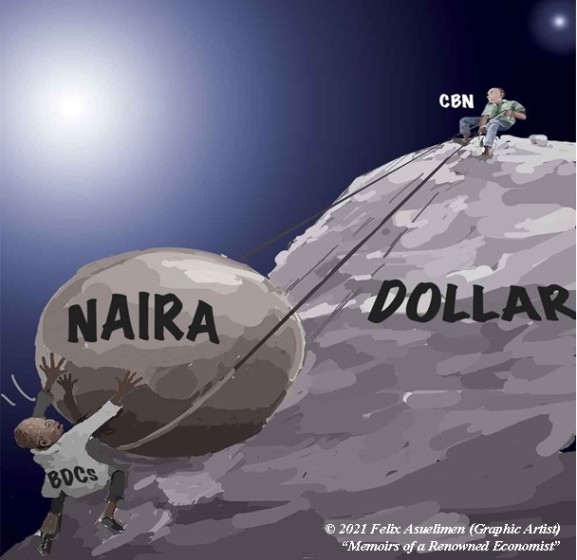

This latter option is recommended because, any attempt to spend most of the huge dollar reserves in the domestic economy instead of using it for clearing the default component of our debt burden will create serious dislocation to macroeconomic stability. The need to convert the huge dollar revenue to naira before sharing to beneficiaries will evoke the scourge of excess liquidity with the attendant train of high interest rates, increasing inflation, weak naira, low capacity utilization, low demand, high unemployment and insecurity in the land. The recently published expectation of the CBN that the naira would be stabilized by the supply of more dollars from the huge reserve to the Dutch Auction market will become impractical in view of inherent contradiction in the effects of this strategy. The truth is, only a liberalized foreign exchange market can strengthen and stabilize the naira value.

Finally, we should sound a note of warning on the risk of devaluation in the real value of our current reserve base of almost $20 billion. The dollar has fallen by over 30% vis-à-vis the Euro and Sterling, the currencies of our major trading partners to whom we owe most of our external debt! The implication here is that most part of our debt burden predicated in these currencies have in reality, technically increased by almost the same margin of 30%. If the dollar depreciation persists while we continue to keep idle dollar reserves, we may unwittingly be adversely impacting on our external debt burden and the possibility of repayment of interest and capital on schedule may continue to be a pipe dream and the escalating debt burden may finally enslave us.

SAVE THE NAIRA, SAVE NIGERIA!!!

PS/ Copies of the earlier articles of ‘Rational Perspectives’ are available on the internet on this link: www.betternaijanow.com which you can access by registering as a member. Registration is free. You may also use this medium to publish your views on the Nigerian economy.