GLOBAL FINANCIAL CRISIS AND US

By: Sir Henry Olujimi Boyo (Les Leba), first published in October 2008

INTRO:

In the last few weeks and months, we have seen how the impact of crude oil prices (ranging from as low as U$20/barrel to as high as U$70/barrel) has affected our economy.

This has become a cycle we should now be conversant with as it has always depreciated instead of strengthening the value of our currency, relative to increased earnings for our great nation. It is apparent that our so-called leaders seem to be comfortable with this cycle which consistently places us in quite a predicament. Our budget estimates were based on lower values of income of about U$40/barrel, and now a possible excess unplanned income which should remedy our position has rather hiked prices of transportation, food etc. and as a result worsened current economic conditions in light of the covid 19 crisis!

It is an understatement to note how crucial it has been to continue referring to Late Sir Henry Boyo’s articles in order to highlight the stagnant nature of our economic climate. For example, today’s article published 12 years ago, is still highly relevant now.

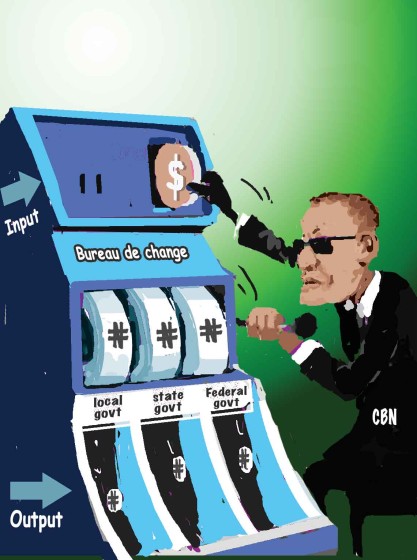

Recently the CBN introduced a Naira for dollar policy. Like the policy introduced in December 2020, this policy would still not encourage diaspora remittances. The reality is such that ‘physical’ dollars are not available locally to back this level of the electronically generated income. No one will send money to their friends or family if the banks don’t have the physical dollars to payout!

Instead, why not introduce policies to encourage individuals locally to deposit their forex…? On that note let us take a critical look at today’s article from the archives titled “GLOBAL FINANCIAL CRISIS AND US” first published in 2008. To paraphrase the old adage, knowledge truly is power.

(These articles are also available on the Late Sir Henry’s web portal, www.betternaijanow.com.)

The common question that I have been asked lately is the extent to which our economy and by extension the beleaguered prosperity of our people will be further diminished by the current turmoil in the world’s financial markets. The architects of our nation’s monetary and economic policies have tried to assuage our anxiety with the assurance that our economy is relatively far removed from the heat of the scalding cauldron in the international capital markets, but also warn that with the inter-linkages in our global village, any major reduction in consumer demand and related industrial growth in the economies of America, Europe and Asia would inevitably burn up our nation’s revenue earning capacity as demand for our monocultural crop of crude oil would automatically drop. Nigerians should naturally be concerned with current events in global markets since over 85% of monthly distributable revenue to the three tiers of government and other parastatals in Nigeria are derived from our export of crude oil.

The immediate fallout of the crisis has been the price of crude oil tumbling from over $140/barrel in July to a modest $80 or so per barrel this week. Nigerians have generally expressed surprise that the considerable export revenue which was gleaned from the erstwhile upbeat crude oil market particularly in the last few years have not impacted positively on our social welfare or on the decrepit vestiges of our infrastructure.

It is pertinent, therefore, to wonder how poverty in the land can be ameliorated with lower revenue when we failed to take advantage of the years of plenty! The predicament of our depleting revenue profile as a result of lower crude prices, may indeed, be worsened by insecurity in the Niger Delta, which could further reduce crude oil output well below the budget benchmark of about 2m barrels/day.

Thus, a weird combination of falling global demand, price, and crude output constraints may, in fact, scratch out any hope of infrastructural enhancement as monthly distributable income may become barely sufficient for the payment of staff salaries and other recurrent expenses in the budgets of federal, state and local governments. Such revenue depletion will also dim the possibility of job creation and reduction of the vast army of unemployed in the land, and our ill-equipped and poorly paid law enforcement agents may be no match for the inevitable surge in the level of insecurity, which would, in turn, discourage the potential for foreign direct investment.

In other words, the global financial crisis is certainly bad news for Nigerians and our almost total dependence on oil has put us on the frontline, even though we are thousands of miles away from the economically embattled world markets. Any hope that International Aid Agencies and the United Nations multilateral financial outfits will come to our rescue may well be misplaced, as donor agencies also depend largely on thriving and buoyant economies for the source of funds, they subsequently channel to needy parts of the world. Thus, revenue inflows for the fight against AIDS, polio, river blindness, malaria and other forms of food aid to ameliorate nutritional deficiencies may suffer severe cut back to the detriment of the poor.

It is projected that the Nigerian economy derives almost $10bn annually from money transfers from relations who work abroad. This sum may represent about 10 – 20% of the legitimate income of these Nigerians. The reality is, however, often ignored that this ‘optical’ addition to our export revenue is, in fact, the cosmetic face of brain drain which belies the loss of the services of well educated, vibrant, hardworking and able Nigerians to our development efforts, while they spend between $80bn - $90bn (80-90% legitimate income) in the economy of their host countries. Nonetheless, a slowdown in the international economy would mean fewer jobs in Europe and America and it is easy to predict those workers who would be the first to be fired in such circumstances!

Ultimately, the erstwhile income to aged parents, relations and dependants in Nigeria may shrink considerably, and create trauma for the beneficiaries back home and may facilitate untimely deaths, increasing poverty and possibly induce insanity in others! Meanwhile, increasing job deprivations and poor remunerations at home will drive more and more of our youths onto perilous journeys across the Sahara Desert and turbulent seas and oceans in search of elusive greener pastures. In addition, the security of lives and properties of these immigrants may become jeopardized from the backlash of indigenous host population who see them as threats to their own job opportunities; issues relating to racial violence may ultimately become a more regular feature in news bulletins worldwide and we may witness mass deportations of illegal migrant workers sooner than later!

In recognition of the above evolving scenario, I have also been asked why our government has not also pumped more money into our banks in line with the billions of dollars bailout by the US and other European governments so that our banks would have enough funds to continue with their business of lending to customers and interbank and thus domestically prevent the credit crunch that facilitated the recession abroad?

The truth is that there is no logical reason to cure someone who is not sick in the first place; our stock market problem could not be a credit crunch when the CBN incessantly mops up excess cash from the banks every week! Our banks still continue to declare humongous profits in excess of previous years’ performance, oftentimes by as much as 100% and remain the premium equity in our stock market! But then, I am asked, in that event, why have most equities, particularly those of banks lost almost N4000bn in the last six months? The reality, of course, is that while the global credit crunch is driven by failures in the real sector, particularly, the mortgage market which caters for the tangible social welfare need of shelter for millions of Americans and Europeans, it is common knowledge that stock prices in the Nigerian market have been subject to overt manipulation by banks in cahoots with their stockbrokers, while the regulators looked the other way!

However, the underbelly of the market became apparent when stock dividends fell below 2% of the equity market price at a time when inflation is running at over 10%. The negative return is enough stimulus for shareholders to offload such equity for more profitable offerings, especially risk-free government borrowings carrying up to 10% return on treasury bills and bonds issued by the government to remove “excess” cash from the financial system. The attempt by the market to right itself has been counter managed by the CBN with various liberal concessions which, in spite of CBN’s claims of a cash saturated economy were expected to create over N1000bn additional liquidity in the hands of banks and encourage recovery. Nonetheless, the unyielding decline in stock values in spite of these hastily contrived beams is an indication that the chickens may have truly come home to roost! Incidentally, this time, it would not be wise to trust any economic missionary package from the IMF and World Bank to save us, when these institutions have failed woefully to even anticipate and prevent the fire raging in their own backyard.

Save the Naira, Save Nigerians!