SHOULD THE NAIRA BE DEVALUED?

By: Sir Henry Olujimi Boyo (Les Leba) first published in March 2014

INTRO:

Last week, this column republished ‘Monetary Policy Committee as Metaphor for the Blind Leading the Blind’.The article provided insight on the influence of monetary policy on businesses and the macroeconomy in Nigeria.

(See www.betternaijanow.com for this series and more articles by the Late Sir Henry Boyo)

Today’s republication is in the form of a questionnaire that poses relevant questions to reveal a clear perspective on the everyday workings of the Nigerian economy. Readers will gain insight on Naira depreciation, what causes it, and why it is of no benefit to the concept of prosperity in Nigeria.

As you read through the below article taking note of previous events or rates, keep in mind its year of publication (2014), a clear indication that Nigeria’s economic situation is yet to improve even after all this time.

In this week's article, we shall discuss the impact of a weaker exchange rate on various sectors of the economy, and also consider whether or not naira devaluation is imminent and inevitable. For this exercise, we will hereafter provide answers to some of the most frequently asked questions regarding the naira exchange rate.

QUESTION: Why are some experts recommending that the naira rate of exchange be devalued?

ANSWER: Indeed, the suggestion that the naira is overvalued is not new, as even the managers of the much celebrated, yet comatose economic empowerment and development strategy, NEEDS, had, over a decade ago, indicated N180 as the appropriate equilibrium and desirable rate of exchange for the naira. Much more recently, however, the huge untamed market demand for the dollar may have influenced the suggestion by some experts that the naira should be quickly devalued to avoid a catastrophic free fall.

QUESTION: Would the naira rate become stable with devaluation?

ANSWER: Historically, the naira exchange rate has suffered multiple devaluations, which evidently, did not prevent further naira depreciation over the last two decades. Consequently, another official devaluation of the naira would not necessarily induce long-term stability of the naira.

QUESTION: Experts have claimed that naira depreciation would increase our exports

ANSWER: Curiously, this argument has often been made to confuse and deceive Nigerians; interestingly, the Nigerian industrial subsector was more diversified and productive, with increasing employment opportunities when the naira exchange rate remained less than N5:$1. Amazingly, the industrial landscape has become famished, and Nigerian exports, with the exception of crude oil, have actually plummeted, as the naira fell to N160:$1. Sadly, much cheaper imports have quickly replaced the output of our erstwhile thriving industrial subsector. There is therefore, no reason to believe that naira rate below N160:$1 would reverse this trend.

QUESTION: Will a weaker naira reduce inflation?

ANSWER: Capital no! Historically, once again, the rate of inflation remained below five per cent between 1975-85, when the naira was much stronger. In fact, a weaker exchange rate will instigate higher production cost across the board for the productive sector of the economy, and also fuel inflation. All manufacturers, who import vital raw materials for production, have sadly suffered similar fate, with disastrous consequences for growth and employment.

Nonetheless, a weaker naira will not increase the export price or demand for crude oil, which incidentally, still contributes over 70 per cent of government revenue.

QUESTION: Will a weaker naira reduce cost of funds to the real sector?

ANSWER: No! If anything, a weaker naira will actually instigate higher cost of funds, especially when we earn increasing dollar revenue from crude oil.

QUESTION: How does a weaker naira instigate cost of funds?

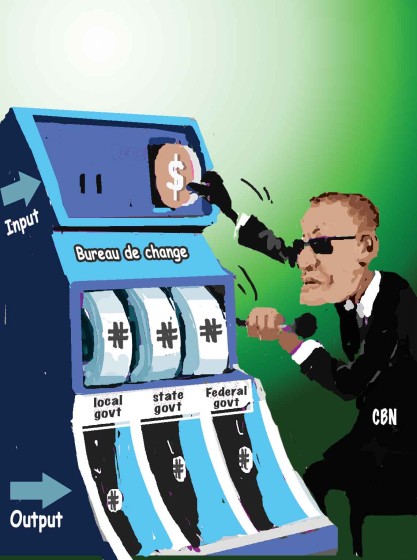

ANSWER: A simple example may suffice; if Nigeria earns $1bn from crude oil, with naira exchanging at N1:$1, the three tiers of government would therefore, share N1bn; if on the other hand, the exchange rate falls to N160:$1, the $1bn forex revenue would be substituted with freshly created N160bn before distribution to the three tiers of government. Inadvertently, the payment of N160bn would instigate the burden of excess naira supply, in bank coffers. However, the fear of excess naira chasing relatively fewer/static volume of goods and services and precipitating inflation, will compel the monetary authorities to restrain liberal access to the surplus funds unleashed on the system by CBN's increase in money supply with naira substitution for distributable dollar revenue.

The CBN would, consequently, proceeds to restrain lending to customers, by offering to pay mouth-watering interest rates above 12 per cent to banks in order to reduce consumer demand and borrowing, and stop inflation. Obviously, banks are happy with this arrangement, which allows them to earn double-digit 'subsidy' on what are ordinarily risk-free loans to government! Such high returns inadvertently also reduce the attraction of lending to the real sector.

Thus, the more dollars we earn, the greater will be the threat of surplus naira and the attendant regime of high interest rates, with CBN's unconstitutional substitution of fresh naira supply for dollar revenue.

QUESTION: Will a weaker naira reduce fuel prices and subsidy?

ANSWER: Once again, the answer is no; in actual fact, if petrol price remains at the current level of N97/litre, a weaker naira will increase the domestic price of fuel, and will also increase the value of fuel subsidy. For example, international crude oil price remains the benchmark price for the feed stock of all refineries worldwide; thus, if 1litre of petrol sells for $1 ex refinery, this would be equivalent to N160 in Nigeria. If conversely, the naira rate falls from N160: $1 to, for example, N200/litre, although this would not affect the price/demand for our crude oil exports, this would mean that the same petrol ex-refinery in Nigeria would sell for N200/litre.

Furthermore, if however, petrol continues to be sold domestically at N97/litre instead of the actual market price of about N147/litre, then, of course, this would increase subsidy value to N103/litre, instead of the current N53/litre with $1: N160 exchange rate.

QUESTION: Will a weaker naira reduce the dollarization of the economy and stop capital flight?

The truth, of course, is that a weak and unstable naira rate of exchange will actually promote dollarization of the economy. A continuously depreciating naira elicits less consumer confidence in holding the local currency as a store of value. Conversely, however, a stronger and stable naira would induce confidence, and make the local currency desirable as a means of exchange and a solid store of value, at the expense of other foreign currencies.

Inevitably, therefore, the greater the intensity to forsake the naira because of continuous depreciation over time, the greater will also be the propensity for capital flight as well as the adoption of dollars, for local transactions.

In reality, a weak naira exchange rate is actually not the result of reduced earnings of dollar revenue; in fact, evidence on ground suggests that the naira rate of exchange has steadily fallen simultaneously with vastly improved foreign reserves. For example, in spite of our relatively paltry reserves of $4bn with four months' imports cover from 1995, the exchange rate remained at N80: $1 for over four years. Curiously, however, the naira exchange rate fell to below N150: $1, when our reserves rose above $50bn with over 15 months' imports cover about three years ago!

Undoubtedly, however, a weak naira is actually the product of the surplus naira caused by CBN's monthly substitution of naira allocations for dollar revenue.

SAVE THE NAIRA, SAVE NIGERIANS!