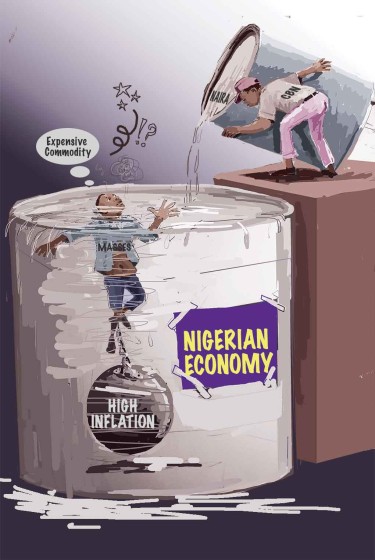

SYSTEMIC SURPLUS NAIRA AS ECONOMIC POISON

By: Sir Henry Olujimi Boyo (Les Leba) first published in May 2014

INTRO:

Last week, this column republished ‘Should the Naira Be Devalued?’. The article provided responses to relevant questions in order to provide insight on the root causes of inflation and how it contributes to a declining economy.

(See www.betternaijanow.com for this series and more articles by the Late Sir Henry Boyo)

Today’s republication is within the theme of last week’s article. It is also presented in interview style format to emphasize the urgent situation Nigeria has found itself in for decades, and to portray the inevitability of things worsening if the right policies and actions are not set in motion. The article provides targeted information to facilitate depth on concerns related to inflation and exchange rate disparities.

As you read through the below article taking note of previous events or rates, keep in mind its year of publication (2014), a clear indication that Nigeria’s economic situation is yet to improve even after all this time.

In last week's article, we discussed the adverse consequences of a flagging naira exchange rate, and observed that historical evidence suggests that further naira depreciation would simply deepen poverty nationwide. However, we also noted that available evidence, in fact, suggests that the naira exchange rate has ironically, steadily dipped inversely with vastly improved foreign reserves and extended imports demand cover".

Hereafter, we will provide answers to some questions relating to the primary cause of a constantly depreciating naira despite bountiful dollar revenue predominantly garnered from crude oil export.

QUESTION: Why have you relentlessly campaigned for a stronger naira for over 10 years?

ANSWER: By 2001, I became concerned that despite our rapidly increasing dollar reserves, the naira exchange rate inexplicably continued to depreciate below the N80: $1, which existed prior to our return to democracy.

It was also ironical that the depreciation was despite our relatively buoyant reserves, which were officially reported to provide extended imports cover than was possible with the existing $4bn total reserves between 1996 and 2000.

QUESTION: What was responsible for the weaker exchange rate despite more bountiful reserves?

ANSWER: Well, it was clear that the weaker naira was not actually the result of dwindling exports revenue, and it was worrisome that the Economic Management Team also insisted that there was surplus naira supply in the system, even when the real sector, particularly the Small and Medium Enterprises (SMEs) bitterly complained of lack of access to cheap funds.

QUESTION: So, what causes the surplus naira in the system, and why is it not available to the real sector at reasonable costs?

ANSWER: After several months of diligent observation, it became clear that the destabilising burden of excess naira supply is accentuated every month, whenever hundreds of billions of naira allocations are paid into the bank accounts of the three tiers of government.

QUESTION: Are you saying that it is wrong to make these allocations?

ANSWER: NO. It is constitutionally appropriate to make monthly revenue allocations, but it was disturbing that despite the reality that 80% of government revenue was denominated in billions of dollars from crude oil export, surprisingly, only naira values were ultimately distributed.

QUESTION: What happened to the original dollar revenue?

ANSWER: It was clear, therefore, that someone or some government agency had unilaterally substituted naira allocations for the distributable dollar revenue at their own unilaterally determined exchange rate, (contrary to the provisions of Section 162 of the 1999 Constitution).

QUESTION: How does the ensuing consolidated bloated naira allocations affect the economy?

ANSWER: If, for example, the CBN substitutes a fresh supply of N160bn as the equivalent of $1bn revenue, such fresh naira cash inflow would support almost a ten-fold leverage in the credit capacity of commercial banks. Thus, if the mandatory cash reserve ratio stood at 10%, the banks will consequently, have an enhanced capacity to lend out about N1600bn, instead of the actual initial deposit of N160bn.

QUESTION: Is this what is generally termed as excess liquidity?

ANSWER: Yes, if the banks were to take full advantage of their enhanced credit capacity to liberally extend loans, this would induce excessive demand with so much easy money being available for bank loans for all forms of consumptions.

QUESTION: This would lead to inflation. Wouldn't it?

ANSWER: Yes, it would; as you know, too much money chasing too few goods would lead to an inflationary spiral, which quietly deepens poverty. Similarly, too much naira chasing rationed dollar supply will also weaken the naira exchange rate.

QUESTION: So, how does CBN react to such a situation?

ANSWER: CBN “altruistically” steps in and offers to borrow and reduce the bloated size of the cash and credit available, by offering mouthwatering double-digit interest rates to commercial banks to encourage them to part with some of the ‘excess’ funds in their custody.

QUESTION: How do the banks react to the CBN's strategy?

ANSWER: The banks are, of course, happy to lend government's money back to government at between 10 and 16% interest rates, as belatedly revealed by Lamido Sanusi, last year. Thus, with such abnormally huge returns for what are actually sovereign risk-free loans, it is not surprising that the banks show little interest in lending to an infrastructurally-challenged real sector.

QUESTION: Is CBN actually responsible for the high interest rates charged by the banks?

ANSWER: Yes, CBN’s objective is to restrain access to the surplus funds, so as to arrest inflation; higher interest rates undoubtedly remains a useful deterrent to borrowing. Regrettably, other public sector borrowings will inevitably also suffer the resultant oppressive cost of funds!

QUESTION: So, what does the CBN do with the funds it mops up at such high cost?

ANSWER: Curiously, those funds so borrowed by CBN are simply kept idle; remember that CBN’s objective for borrowing is to reduce spending. Consequently, it will result in misapplication (compounded naira surplus) if the borrowed funds are again made available by the same CBN for either public or private spending.

QUESTION: You can't be serious!

ANSWER: No, this is no joke. Indeed, this kind of socially oppressive borrowing by government annually increases the size of our national debt, and it costs the nation over N300bn to service such debts annually.

QUESTION: How does the surplus naira affect the exchange rate?

ANSWER: Well, it is a matter of supply and demand; CBN's unilateral substitution of naira for dollar revenue inevitably induces the destabilising burden of excess naira supply. Consequently, with available naira values in multiple fold excess of the actual amount of substituted dollar revenue, the naira exchange rate will inevitably, consistently fall against the dollar in the money market.

QUESTION: So, are you saying that the naira rate has nothing to do with productivity and a diversified economy?

ANSWER: In reality, our rebased Gross Domestic Product is a clear indication of increased productivity; however, it is inexplicable that despite the almost doubled GDP, the naira exchange rate has ironically continued to weaken in the last 20 years.

Indeed, the expectation of a diversified and inclusive economy with increasing job creating opportunities will hardly materialize, so long as government consciously continues to borrow back its own money at double-digit interest rates, while actively preventing access to adequate and supportive cost of funds to the real sector, particularly the SMEs, which are the growth engines in all economies.

Fortunately, however, allocations of dollar revenue with “dollar certificates” is undoubtedly a potent antidote to the economic poison of surplus cash in our developmental strategy. (See “The Sensible Path to Economic Prosperity” at www.lesleba.com)

SAVE THE NAIRA, SAVE NIGERIANS!