CBN VS THE PEOPLE (2)

By: Sir Henry Olujimi Boyo (Les Leba) republished in April 2012

INTRO:

Last week, this column republished ‘CBN vs the People’ The article contains a letter to the CBN insisting on transparency and accountability. If you missed this article, all republications can be found in the archives using the below link.

(See www.betternaijanow.com for this series and more articles by the Late Sir Henry Boyo)

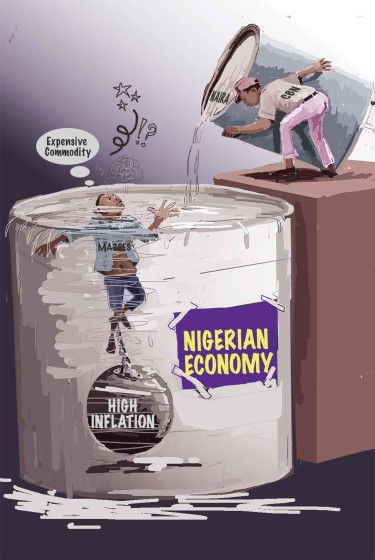

Today’s republicationreflects on the CBN’s mismanagement of the Nigerian economy and the effect this has on inflation levels, unemployment rates and investment which all impact the welfare of the nation. The article is in interview style format, containing thoughtful responses to emphasize that the CBN’s substitution of naira for dollar-derived revenue is not only detrimental to Nigeria’s economic prosperity, but unlawful.

As you read through the below article taking note of previous events and rates, keep in mind its first republication (2012), a clear indication that things remain stagnant even as we face the year 2023.

In the first part of this article, which was published last week, we gave a brief narration of how Lamido Sanusi and his predecessors as Central Bank Governor brazenly discountenanced alternative advocacy that could redeem and positively transform our economy.

If these eminent public officers were patriotic and sincere, they would readily agree that something must be fundamentally wrong with their economic management strategy. Regrettably, for CBN, Finance Ministry and other members of the various Economic Management Teams (EMT), it has been business as usual with liberal propaganda to deceive our people; as a small, but critical subsector, it would, of course, be unusual for these government agencies to exhibit values, which contrast with the pervading culture of double talk, waste, corruption and arrogance in public service. The EMT adopted the strategy of liquidity programming and forecasting to counter the dreaded plague of excess liquidity (excess cash), which the authorities rightly recognize as a condition that continues to make economic progress largely impossible. The scourge of surplus cash remains abiding and more potent than ever, and CBN Governor himself has publicly projected an inflationary rate of between 14 – 15% by 2nd quarter of 2012! The cost of borrowing, on which our hopes for economic and industrial resuscitation largely rest remains particularly burdensome at over 20% for industrial and commercial activities with traditionally long gestation.

Meanwhile, unemployment has continued to rise and is today at its worst ever level with close to 40 million Nigerians unemployed, with our youth population constituting over 50% of this huge burden. There is a general recognition that our current unhealthy level of insecurity is largely sustained by the scarcity of job opportunities. So far, it appears that CBN and EMT are resolved to retain the same policies that gave rise to the deepening poverty.

In an attempt to call CBN and EMT to order, my colleague, AdaighofuaOjomaikre, and I decided, after over ten years of fruitless advocacy, to seek legal counsel; in this pursuit, we found the patriotic legal luminary Femi Falana a willing ally. Well-meaning Nigerians would join us to express our gratitude to Mr. Falana, as this true son of Nigeria quickly recognised that CBN’s substitution of naira allocations for dollar-derived revenue was not only the poison in our economy, but that this practice was unconstitutional, as it stood against the provisions of Section 162 – 1999 Constitution (amended). It is pertinent to note that Mr. Falana did not at any time discuss the issue of a fee for this exercise! The following are Mr. Falana’s responses to a selection of questions from the Media:

Q: What is the national interest issue involved in your FOI request to CBN?

A:Nigerian economy is the national interest involved in my clients' request under the FOI Act. In protecting the national currency from the manipulation of the management of CBN the request is anchored on section 162 of the Constitution. It is designed to promote the economy under the rule of law. In Gani Fawehinmi v the president where the appellant challenged the illegal payment of salaries in dollars to 2 ministers the court of appeal held that every Nigerian has a duty to question the violations of the laws of the land.

Q: If your request is granted what will be the next step to be taken?

A: If the request is granted the three tiers of government will be issued with dollar certificates instead of the current practice of issuing them with naira warrants albeit illegally.

Q: Your clients are convinced that the economy is adversely affected by the substitution of revenues in foreign currencies with Naira funds. What is the constitutional issue involved?

A: The benefits of complying with the constitution have been set in our letter. However, if the request is not granted we shall head for the court.

Q: How do you locate all of this within the issue of our defective federalism?

A: The monopoly of the federation account by CBN is a distortion of federalism. In AG Lagos v AGF the supreme court held that it was illegal on the part of the president to withhold funds due to Lagos LGs in the federation account. Similarly, it is illegal on the part of CBN to replace foreign currencies in the federation account with naira funds.

Q: Don’t you think the National Assembly might legitimize the action of CBN?

A: Without an amendment of the constitution, NASS lacks the power to legalise the action of CBN.

We will close this week’s article with web excerpts from three readers, who have closely followed our advocacy for breaking the monopoly of the foreign exchange market by CBN, and the beneficent impact this would have on the economy.

The following is the comment from Jide Swaggart, a petroleum-engineering consultant, from Benin City. Please read on.

“I am not an economist but I am conscientiously compelled to comment on Henry Boyo’s piece. I watched him on Channels and AIT during fuel subsidy (hike) saga where he did not change the rhythm of his swan song, which he still clearly enunciated in his article: “Breaking the Central Bank of Nigeria’s Forex Monopoly”. I did not understand his viewpoint during those early Channels TV’s debates but with time, his point became clearer to me.

“If this is as simple as my first-year economic theories though the theories do not hold per applicability, then I strongly agree with him that sharing printed naira for dollar-derived revenue in monthly allocation among the government tiers will continually increase the $/N parity. To my inclination, the point is that the tiers of government still take about 30-40 per cent of this naira allocation to pursue dollar needed for developmental projects execution and sundry. So why earn dollars, print naira, and use the naira to buy dollars in a game that is supposedly driven by demand and supply? I remember that the former CBN governor, Chukwuma Soludo, had during the tail end of his tenure attempted this dollar sharing policy canvassed by Boyo but this was greeted with the usual Nigerian trivialities of disregard for our own currency. The late President Umaru Yar’Adua finally laid that idea to rest.

“A simple analogy with what happens in other oil producing and economically more prosperous countries than Nigeria such as Qatar, Oman, United Arab Emirates, and even Angola is the allowance for free flow of dollar in their economy. In these countries, the dollar is accepted in shops and markets; one does not necessarily have to change it to their local currencies to make purchases. My understanding of this is that the availability or surplus circulation of the dollar increases the competitive edge of their local currency against it.

“The dollar is more or less the standard of currency measurement; as such the measure of worth for N1 is not entirely in numeracy of 100 kobo makes N1 but more in its equivalency with dollars. For instance, what makes N18, 000 minimum wage a less than take-home pay is more because of its worth in terms of dollar equivalency rather than its numerical worth and so people often refer to good old days. Good old days have continued to exist not only because of the inflation drag but more because of exchange rate which progressively weakens the naira. True to Boyo’s submission, how do you explain the exchange rate stability during late Gen. Sani Abacha’s rein even with his anti-West posture?

“I am beginning to build a conspiracy theory around what governance is in Nigeria. Our government seems to be working like a department in the United States State Department. Our monetary policy guides and protects the dollar against the naira. The government of Obasanjo paid out millions of dollars to the Paris Club in the name of debt because Dr. Ngozi Okonjo-Iweala told us it was the path to fixing the economy. People like Sanusi Lamido Sanusi, to my mind, are buoyed by selfish ambitions than any national interest. This is a lofty incentive enough to sway blood relations against one another.

“When ideas that oppose government policies flow from members of the public, I expect a listening and responsible government to open it up for debate so that the merits and demerits could be weighed against the prevailing policy. We watched this often on CNN where government officials are pitched against public analysts and commentators to debate government policies. In Nigeria, everyone in government knows more than the rest of us. We saw the arbitrariness during the fuel subsidy probe where the country’s petroleum consumption figures shifted at will and population figure adjusted to balance per capital consumption.”

The second comment culled from the web is from a certain Remi in Lagos, and reads as follows:

“The fact of the case is that if Henry Boyo’s idea is implemented, a lot of the banks will become distressed, as they are the greatest beneficiaries of the currency policy. CBN pays them interest for loans CBN does not need. That is why they declare fantastic profits while the real sector of the economy is in coma. Implementation of Boyo’s idea will make our banks more friendly and responsive to the needs of their customers while working for their profits, with the real sector benefiting from scramble of banks to grant loans (to earn ‘legitimate’ incomes).”

The last of our readers’ comments comes from Engr. Segun Ogunlola and reads as follows:

“I have been following your write-ups for over a year now and your message has always been the same, which is that, in order to strengthen the naira and curb inflation, CBN should stop the substitution of naira for dollar derived revenue and should rather proceed with the issuance of dollar certificates to the three tiers of government during revenue sharing. I must confess that this didn`t sound convincing to me initially but during the fuel subsidy crisis in January it started making sense.

“Now, I`m curious and want to know why CBN or any other government economic agency has never deemed it fit to publicly react or respond to this position. For example, CBN governor, who we all know to be very vocal on ‘economic’ matters, should normally have responded by now even if it is to punch holes in your argument ditto for the ‘World Bank Experts’ running our economy. Their silence points to a grand conspiracy to cover up what you are trying to expose. I am very convinced that this position needs to be seriously debated. What about getting the Nigerian Economic Society and even our academia involved?

“I urge you to continue to put this on the front burner of our national discourse as it may just be the saving grace for our failing economy.”

SAVE THE NAIRA, SAVE NIGERIANS!!