FUEL SUBSIDY AS A FUNCTION OF ILLEGAL EXCHANGE RATE MANIPULATION

By: Sir Henry Olujimi Boyo (Les Leba) republished in April 2013

INTRO:

Last week, this column republished ‘The Bogey of Fuel Subsidies’. The article is written in interview style to appropriately address relevant questions regarding the issue of fuel subsidy. If you missed this article, all republications can be found in the archives using the below link.

(See www.betternaijanow.com for this series and more articles by the Late Sir Henry Boyo)

This week’s republication refers to previous events relating to discussions about a“partial”fuel subsidy removal. It discusses the role of inflation as a threat in relation ideas on subsidy removal and criticizes government practices that continue to contribute to Naira devaluation. With the level of misinformation on this topic, this column would be republishing a few more of Sir Henry’s articles relating to fuel subsidy in the coming weeks. Stay tuned.

As you read through the below article taking note of previous events and rates, keep in mind its first republication (2013), a clear indication that Nigeria’s economic situation remains stagnant even as we face the year 2023.

At a forum in Lagos, on Tuesday, 19/3/2013, President Goodluck Jonathan insisted that "we cannot continue to waste resources meant for a greater number of Nigerians to subsidize the affluent middle class, who are the main beneficiaries (of fuel subsidies)".

A day later, the Minister for Information, Mr. Labara Maku, also observed that "if we insist that government will be the one refining products for the Nigerian market, we will remain truncated…. The government money that should have been used for development is paid to marketers, who turn around to get more money from Nigerians. So, in the end, government and Nigerians are losing; the sector is also losing".

Incidentally, on the same day Mr. President was extolling the virtues of deregulation in Lagos, an Abuja Federal High Court, presided over by Justice Adamu Bello, granted all the release sought by the Plaintiff, Mr. Bamidele Aturu, a Human Rights Lawyer, and consequently made a declaration that “the federal government's decision to deregulate the downstream sector of the petroleum industry by not fixing the prices at which petroleum products might be sold in Nigeria was unlawful, illegal, null and void, and of no effect whatsoever, as deregulation was in flagrant violation of the mandatory provision of Section Four of the Price Control Act, and also in conflict with Section 16(1)(b)of the 1999 Constitution, which provides that “the government shall control the national economy in such manner as to secure the maximum welfare, freedom and happiness of every citizen on the basis of social justice and equality of status and opportunity”.

Conversely, however, a PDP stalwart from Anambra State, one Chief Stanley Okeke, has recently also, according to a report titled “Nigerians Condemn Plans to Increase Fuel Price” in Punch edition of 21/3/2013, challenged the validity of fuel subsidy and has consequently, asked a Federal High Court to compel President Jonathan to totally withdraw subsidy on fuel.

However, public reactions gleaned from social media network is equally indicative that low-income earners strongly oppose any hike in fuel prices beyond the present N97/litre, which they already decry as severely oppressive. In the Punch report under reference, one Mr. Sunday Njokede warned that "Jonathan can remove subsidy while Nigerians will remove him from Aso Rock in 2015".

Some Nigerians have similarly queried the benefits of the partial removal of fuel subsidy, and claim that the impact of the SURE-P programme remains to be felt in the critical areas of health, education and transportation.

In view of the pervasive impact of fuel prices on the general price level, the purchasing power of all income earners, particularly the poor, will be severely eroded, if Nigerians pay over N140/litre, without subsidy. Besides, Nigerians are unhappy and feel insulted by the snail-pace of the prosecution of bogus fuel marketers, who defrauded the Federal Government with their subsidy claims. Other Nigerians also bemoan the low output from our four refineries, and wonder why government appears uninterested in building additional refineries. Regrettably, also, there are no reports on the M.O.U. signed in May last year with an American corporation to build and operate six modular refineries within 12 months!

Media reports also suggest that representatives of the Nigeria Labour Congress and Trade Union Congress have also warned against any further rise in fuel price.

The above narrative suggests that there is no imminent solution to the fuel subsidy imbroglio; however, such conclusion can only be correct if the issue of naira exchange rate is excluded from the permutations of the solution. We will explain this observation with a simple example, thus; if petrol (PMS) sells at the international commodity price of, say, $1/litre, this would translate to about N160/litre with current exchange rate; if, however, naira exchanges for N80=$1, then the price equation will become 1litre=$1=N80, which is a price well below the current tolerated price of N97/litre! In other words, petrol can consequently sell at the agreed price of N97/litre with N17/litre as sales tax.

Incidentally, with estimated consumption rate of 35m litres daily, this would translate to a revenue of almost N60m/day or N20bn/year in place of current subsidy payments of over N2tn, which will now become available for positive infrastructural revitalisation.

Conversely, if the international price of PMS remains unchanged at $1/litre while naira exchange rate falls to N200=$1, our domestic price of fuel will rise to N200/litre and subsidy payments may deepen beyond N4tn if current price of N97/litre is unchanged.

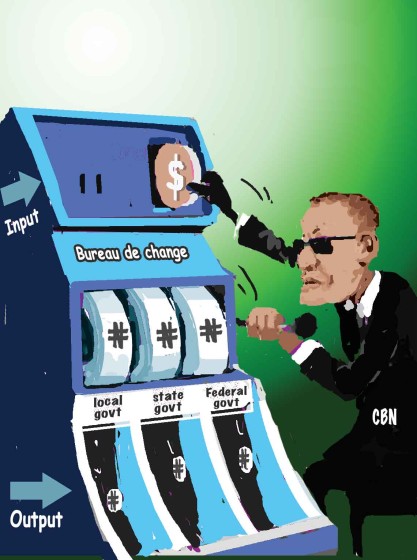

The relevant question therefore is, how then can we make naira stronger, so that domestic fuel prices will fall and make subsidy unnecessary? The answer to this question has been provided in this column in several articles; naira exchange rate mechanism is driven by monopolistic posturing of CBN in the forex market! CBN's unconstitutional tradition of capturing distributable dollar revenue and substituting same with naira allocations gives the apex bank control of over 80% of the dollars traded in the foreign exchange market, and creates those economic distortions peculiar to monopolists everywhere. The weaker naira that evolves from this system also precipitates higher fuel prices and the related inevitable humongous subsidy values.

Nonetheless, there are convincing reasons to believe that if distributable dollar revenue is paid to constitutional beneficiaries with dollar certificates (rather than bloated naira allocations), naira exchange rate will consequently become stronger and drive down domestic price of fuel below levels, which will ultimately eliminate any form of subsidy, and open the door to establishment of private refineries.

SAVE THE NAIRA, SAVE NIGERIANS!!