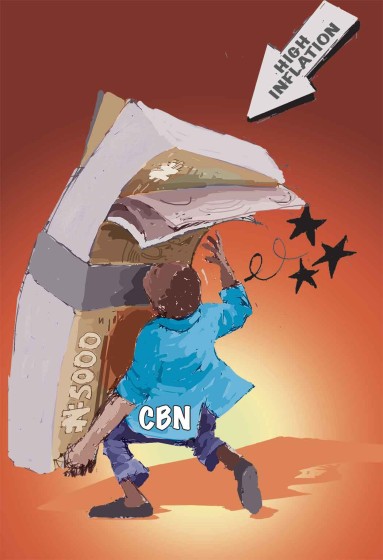

VICTIMS OF DEVALUATION

By: Sir Henry Olujimi Boyo (Les Leba) republished in December 2014

INTRO:

Two weeks ago, this column republished ‘Emefiele and the Inherited ‘Curse’ of Surplus Naira’ the article provided a clear understanding of CBN’s role in fueling the struggles of the nation.

(See www.betternaijanow.com for this series and more articles by the Late Sir Henry Boyo)

This week’s republication discusses Nigeria’s exchange rate volatility in regards to faulty monetary policies formulated by the presently suspended CBN Governor Godwin Emefiele. We can only hope that moving forward, CBN’s leaders would prove to be patriotic law-abiding citizens that take steps to strengthen the Naira. An action which would in turn, positively impact local economic development.

As you read through the below article taking note of previous events and rates, keep in mind its first republication (2014), a clear indication that Nigeria’s economic situationis yet to improve.

Regrettably, in spite of the earlier assurance to maintain Naira exchange rate stability in his inaugural address, the CBN Governor, Godwin Emefiele’s policy summersault with Naira devaluation shortly afterwards, has since led to the National Currency trading around N173=$1, thus establishing Naira depreciation of about 13 percent; alarmingly, the pressure remains unabating and there are real fears that sooner than later, the Naira exchange rate may tumble below N200/$1 with inevitable, severe social and economic consequences.

We cannot exempt any stakeholder or economic sector from the ravages of the ill wind of the recent Naira devaluation. Indeed, some reports already suggest that the Naira may have begun a suicidal slide into ignominy a la the experiences of Ghana and Zimbabwe, where the local currencies became virtually worthless until redenomination temporarily, nominally rescued the Ghanaian Cedi, while the adoption of US dollars for domestic transactions eventually stabilised Zimbabwe’s money market. Predictably, wherever a currency loses significant fractions of its exchange value, poverty will deepen and disenabling economic distortions will prevail and the public will increasingly reject holding such currency as a store of value! Instructively, the Nigerian economy and our people are yet to recover from the insensitive and reckless devaluations inspired by IMF’s Structural Adjustment Programme between 1986-93.

Hereafter, we will look a bit more closely at clearly vulnerable victims of the latest Naira devaluation.

The severity of the impact of the latest devaluation on the general price level may still be difficult to determine, but what is quite clear, is that the minimum increase on shelf/retail prices of goods may exceed 20 percent, since payments for most of such imports will be sourced at the interbank exchange rate, which is destined to approach N200=$1 shortly, with the present pressure fuelled by CBN’s failed strategy for Naira defence. The resultant steep rise in prices will not be restricted to Retail outlets like Shoprite, where, possibly well over 90 percent of goods (including fruits & vegetables) on offer are imported! Sadly, prices of goods sold in our traditional markets and street shops may not fare any better, as imported products have increasingly also taken up shelf spaces in these markets.

Nigerians must, however, immediately dismiss any hope that increases in the prices of imports will ultimately spur local production; evidently, so long as our industrial sector struggles with high energy cost and excessive cost of borrowing (with interest rates above 20 percent), our industries may never successfully compete with imported goods, (which include processed foods and beverages). Ultimately, cheaper, oftentimes subsidized imports will prevail and additional erstwhile factory space may become available for transformation to event centers or churches and mosques; more factory closures will inevitably compound our disturbingly high unemployment rate and the abiding collateral of insecurity and violence.

Nevertheless, it is clear that with the absence of sustainable local sources of raw materials we will continue to be dependent on imported inputs for many years to come; regrettably, a weaker Naira will simply increase the cost of such raw materials and ultimately instigate product cost and fuel inflation.

Similarly, loan default will become increasingly rampant for both private and corporate debtors who thought that it was smart to accept (5-7 percent) cheaper foreign denominated loans as substitute for the much more expensive (17-25 percent) Naira denominated loans. Inadvertently, with Naira devaluation, beneficiaries of foreign loans will, have to find over 20 percent more Naira to service and or repay their debts. Some Nigerians will recall the misfortunes of beneficiaries of government’s NERFUND (Nigerian Economic Reconstruction Fund) dollar denominated loans over 20 years ago! Sadly, most of the businesses funded with those dollar loans became grounded and many erstwhile successful and diligent entrepreneurs lost their ‘shirts’ while some others paid the ultimate price from stress and hypertension from intense pressures to repay their rapidly bloating debts as the Naira rate plunged abysmally to a small fraction of its previous value. Sadly, it may be difficult to identify any surviving industrial beneficiary of the NERFUND scheme today!

As it is with the private sector, so also with public sector external loans. Indeed, Okonjo Iweala, the Finance Minister has assured Nigerians, that relatively cheaper external loans would be sourced to augment revenue shortfall caused by tumbling crude oil prices; on the surface, this might sound sensible, however, the Minister failed to also warn that even if such foreign loans are cheaper we may ultimately still require over 15 percent more Naira to service or repay these external debts if the Naira continues to weaken; Indeed besides the cost of servicing our external debt will also eat deeper into our annual budgets and we may ultimately expend over 20 percent of the federation’s projected revenue for debt services and repayments annually; clearly, it will remain a challenge to fund infrastructural enhancement and poverty alleviation without fresh debts despite the attendant oppressive costs.

Incidentally, our celebrated rebased GDP of $510bn will also contract by at least 10 percent as a result of the latest devaluation.

Furthermore, parents and sponsors of children and wards in overseas educational institutions are all victims of the recent Naira devaluation. Indeed, if school fees are paid at the current interbank rates, the Naira equivalent may increase by almost 20 percent for most sponsors. The cost of air ticketing for overseas travel will also go North in deference to the current devaluation of the Naira, consequently, travel expenses for both private and government passengers will increase and may ultimately lead to curtailment of travel plans and staff training programmes; conversely, distasteful and antisocial trade-offs in the capital expenditure budgets may become imperative for all concerned.

Presently, Foreign Portfolios Investors, who were formerly eager patrons of Naira denominated equities and government’s securities, are quickly making a beeline to exit the Nigerian market, as Naira depreciation continues to wipe off, the once exceptional yields from such instruments. The resultant capital flight has also instigated over a N2000bn fall in equity values in the Nigerian Stock Exchange lately; unfortunately, the trend remains unyielding, with destabilising economic consequences that would shake the confidence of the investing public in the stock market for some time.

Nigerians are of course also concerned that in spite of almost 40 percent drop in crude oil prices, domestic fuel prices have inexplicably remained resistant. The reality of course is that the fall in crude prices will largely be offset by Naira depreciation and may just reduce the element of subsidy in fuel pricing from 50 percent to below 10-15 percent if the Naira exchange rate rises above N190=$1.

In conclusion, the latest devaluation will instigate a significant general price rise which will push inflation rate into double digits and deepen poverty, as all incomes may ultimately lose over 50 percent of purchasing value every 5 years! In truth, unless we adopt creative monetary strategies such as breaking CBN’s monopoly of the forex market, Naira depreciation will persist and real economic growth will remain stunted and things will get worse!

Save the Naira, Save Nigerians!!