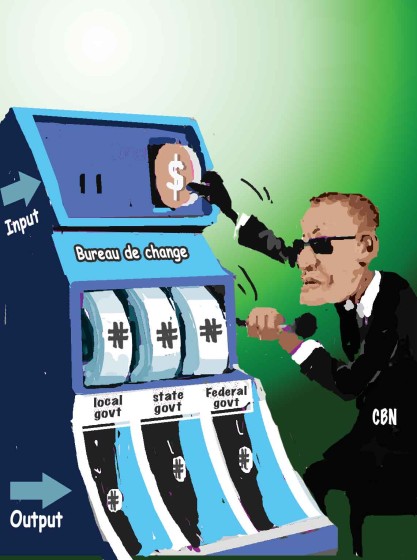

IS CBN DEFENDING THE NAIRA OR DOLLAR?

By: Sir Henry Olujimi Boyo (Les Leba) first published in January 2018

INTRO:

Last week, this column republished ‘Development Versus Debt Peonage (2),’the publication focused on 5 key points that could accelerate progress within the Nigerian economy. If you missed this article, it can be found using the link below.

(See www.betternaijanow.com for this series and more articles by the Late Sir Henry Boyo)

Today’s republication queries the intentions of the CBN and government leaders due to the clear mismanagement of the Nigerian economy. It discusses rising dollar reserves, inflation, and counterproductive practices that depreciate the Naira. Appreciation of the Naira is desirable because it would encourage business activity in the local economy, creating a domino effect that would lead to economic stability and a higher quality of living.

As you read through the below article taking note of previous events or rates, keep in mind its year of publication (2018), a clear indication that Nigeria’s economic situation is yet to improve.

………………………………………………………………………………………………..........................................................................................................................................................

“As I speak to you, our external reserves stand above $31bn and that provides us with enough fire power to be able to defend the Naira (N305=$1)” (Godwin Emefiele CBN Governor, April 25th, 2017).

However, fast forward to January 2018 with reserves above $40bn, i.e., over 30 percent increase since April 2017, and despite the reduction in exchange outflows caused by the ban of non-essentials imports, the naira inexplicably remains between N305-360=$1.

The question, therefore is: “Is CBN actually defending the Naira?” The above title, was first published in Punch and Vanguard Newspapers on 12th January, 2015. A summary follows hereafter:

“Evidently, the serial devaluation from stronger than N1=$1 to an abysmal low of about N70=$1, at that time, was probably, the most significant instigator of the oppressive economic challenges, induced by the IMF imposed Structural Adjustment Programme’ (SAP). Nigeria’s once pulsating industrial base gradually became almost silent, with increasing idle capacity, while millions of workers were offloaded into a rapidly contracting job market. Worse still, the oppressive Naira devaluation reduced wages to ‘peanut’ value; consequently, the ‘check out’ syndrome became fashionable, as, well-heeled professionals, and technocrats sought greener pastures abroad, in order to maintain the accustomed dignity in their lifestyles. Sadly, the impact of the near fatal blows from SAP has truncated our development till this day, and Nigeria is now listed as one of the world’s poorest nations.

Inexplicably, despite exceptionally high crude oil prices, around $140/barrel some years back, with the attendant bountiful dollar reserves accumulated thereafter, the economy has continued to falter. Ironically, rising dollar reserves, and extended payments cover for our imports, have unexpectedly fostered weaker Naira exchange rates, such that one wonders if less reserves would in contrast, unexpectedly induce a stronger Naira!

However, the reduction in export revenue, when crude oil prices later fell below $60/barrel, undeniably, constituted another onslaught on the Naira exchange rate and inclusive economic growth and employment.

Thus, in our quest for a socially and industrially supportive exchange rate, we find ourselves in a bizarre twist of “heads or tails”, we lose. Indeed, as with SAP, the embedded role of IMF technocrats in the management of our economy, also fostered the unfortunate notion that Naira rate is overvalued, even when we had best ever foreign reserves above $60bn and largely extended imports payments cover, Regrettably, government economic blueprints, such as NEEDS, were predicated on this obtuse mindset, that if the economy is not diversified, fortuitously bountiful reserves, will neither induce, a stronger Naira nor spur inclusive economic growth.

Well, today (January 2015), the Naira exchange rate is close to the N180=$1 exchange rate projected to induce economic diversification and growth in the NEEDS blueprint, but sadly, in reality, catalytic lower rates of inflation, and cost of borrowing, with exchange rate stability which should drive inclusive growth, still remain unattainable.

Certainly, no economy can perform creditably, when cost of funds, to real sector remains over 20 percent while stable consumer demand, remains, severely constrained with annual inflation rates of 8-12 percent, while Naira exchange rate, is also sliding nearer N200=$1, despite increasing dollar revenue and extended payments cover.

Furthermore, it is clearly, reckless financial management, for any government to readily pay over N600bn as annual interest to store away the perceived surplus funds it borrows, to restrain inflation, only to turn around to simply sterilize the proceeds of the loan from use, despite the acute shortage of cheap funds with single digit rates of interest, required to drive real sector growth.

Sadly, CBN and our Economic Management Teams have never been able to construct an appropriate growth model which supports low cost of funds (i.e., 3-6 percent), low inflation rate (1-3 percent), with a non-monopolistic and, open forex market that will drive the elusive quest for economic diversification and growth.

Nonetheless, politicians, critics, and a gullible public are once again united in singing the chorus of economic diversification, while they apparently share the illusion that El-Dorado will be attained by simply throwing billions of Naira as intervention funds at various economic sub-sectors. Indeed, in an economy with a burdensome, abiding problem of stupendously surplus Naira, such intervention funds, regrettably, simply compound the existing problem of inflation, which is sustained by systemic surplus Naira. Ultimately, the presence of such surplus funds, would usually instigate another kind of intervention, which compels CBN to step up its own borrowing, despite having to pay excruciatingly high and destabilising interest rates on such sovereign borrowings, which crowd out the productive sector, from access to cheaper loanable funds, which are necessary, to drive lower rates of inflation and boost economic growth, that is characterised by increasing job opportunities, and stable income values.

Clearly, the inexplicable burden of eternally surplus Naira is actually also the major obstacle to achieving best practice supportive indices, required to grow and diversify the economy. Systemic surplus Naira supply is, clearly also, responsible for weaker Naira exchange rates, as CBN’s weekly auctions of modest dollar rations, are pitched, in a market, with excess Naira supply, which invariably creates an imbalance in favour of the dollar!

Nigerians do not usually interrogate the process through which CBN consolidates it’s so called “own reserves”! Indeed, CBN’s strategy of creating fresh Naira values, every time it substitutes Naira budgetary allocations, for dollar denominated revenue, undeniably, induces a market imbalance of an avalanche of Naira surplus, chasing the much smaller dollar rations, which are intermittently auctioned by the CBN; consequently, with this arrangement, CBN, ironically becomes a stronger defender of the dollar, instead of the Naira exchange rate!

Thus, the higher the dollar revenue from rising crude prices and output, the greater also would be the fresh supply of Naira that CBN, would create and place in the economy, as Naira substitute allocations to government, for the actual export dollar income it had earlier captured.

Thus, whenever we celebrate CBN’s rising dollar reserves, we must recognise that the process of accumulating such reserves, is unfortunately, distortional, primitive and retrogressive, as it creates an obtuse paradigm that ensures that the larger the reserves captured by CBN, the greater is Naira liquidity, and the harsher and more counter-productive also, would ultimately be CBN’s monetary control measures.

Thus, it is ironical that the CBN which instigates a market disequilibrium in favour of the dollar when it substitutes fresh Naira values for dollar denominated revenue, should later turn round, in seeming defence of the Naira exchange rate, to invariably bet against its own currency, by intermittently auctioning small rations of dollars in the same market, which it had earlier inundated with Naira supply; unfortunately such a market imbalance will invariably always precipitate weaker Naira exchange rates, which will inevitably increase fuel price, regardless of crude price and output.

In this event, the CBN must immediately stop digging itself into a deeper hole with a Naira defence strategy that has consistently worked against the domestic currency (Naira), over time to deepen poverty.

Furthermore, the elimination of the oppressive burden of excess Naira liquidity will also induce lower rates of inflation and cost of borrowing and leave the door wide open for inclusive economic growth, economic diversification and rapidly increasing job opportunities (January 2015).

Fast forward January 2018: Reserves are now over $40bn; inflation 15 percent plus; Interest rate on real sector borrowing over 20 percent; N305-N400=U$1; unemployment remains untamed, while excess liquidity remains unyielding! Heaven help us!

Surely, the adoption of dollar certificates for government allocations of dollar denominated revenue will eliminate or critically reduce the burden of excess Naira liquidity and therefore give the Naira a fighting chance against the dollar in the forex market.”

Save the Naira, Save Nigerians!!