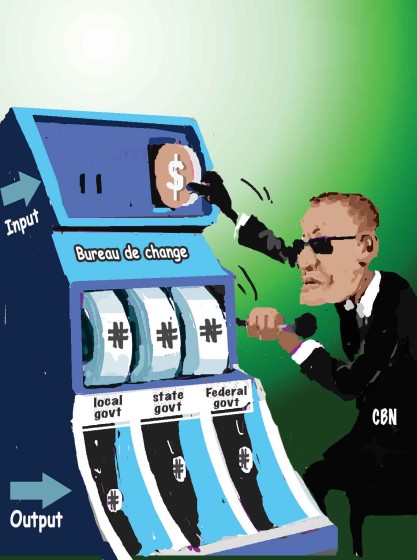

TODAY: N25 BILLION = $188 MILLION; TOMORROW: N25 BILLION = $100 MILLION…THEN WHAT?

By: Sir Henry Olujimi Boyo (Les Leba) first published in January 2005

INTRO:

Last week, this column republished ‘Why Higher Crude Oil Prices Won’t Save Nigeria’s Economy’the article discusses how Naira devaluation occurs and what measures must be taken to correct it. If you missed this article, it can be found using the link below.

(See www.betternaijanow.com for this series and more articles by the Late Sir Henry Boyo)

Today’s republication is divided into sections to effectively discuss the banking system in Nigeria and the role the CBN plays in the devaluation of the Naira. It explains sequentially how this occurred eighteen years ago, and regarding the current further devaluation of the Naira, how this continues to occur as a result of a blatant disregard for proposed recommendations on the part of the CBN and government leaders.

As you read through the below article taking note of previous events or rates, keep in mind its year of publication (2005), a clear indication that Nigeria’s economic situation is yet to improve even after all this time.

………………………………………………………………………………………………..........................................................................................................................................................

The Central Bank of Nigeria, CBN under the new leadership, has in the recent past made known the fact that it has embarked on a structural reorganization and repositioning to enable it perform its role, as the prime regulatory bank, effectively and efficiently so that the consequent enabling economic and monetary environment will support reasonable and enduring economic growth in the country.

New Improved Banking System

The restructuring of the commercial banking system has also been identified as an integral part of the new CBN positioning; the banks have, curiously enough, blossomed over the last decade while the industrial establishments, which would normally be expected to support the success of the banks, have become an endangered species! The CBN has insinuated that most banks have thrived on lucrative government borrowing via treasury bills and bonds and excessive gains from the foreign exchange market! In order, therefore, to re-engineer the banks to play a deeper and more productive role in the economy, the CBN has promised a 13-point programme of action.

The first artillery to be rolled out from the CBN arsenal is the controversial N25 billion recapitalisation by December 2005 directive to existing ‘healthy’ banks in the country. The CBN expects that the fruits of the success of the exercise would include fewer, but larger and stronger banks which can effectively undertake major investment projects and compete favorably on the international arena. It is also the expectation of the CBN that the new ‘mega’ banks would be more efficient and effective in the delivery of banking services that would support a vibrant industrial, agricultural and commercial climate in the country.

How Appropriate is N25 Billion Capital Base?

It is not yet certain how the CBN arrived at the magic figure of N25 billion as the ‘minimal capital base’ required for a commercial bank to operate in Nigeria. What is currently certain, however, is that N25 billion is equal to $188 million dollars at today’s exchange rate of about N133 per dollar. In other words, the CBN considers that such ‘megabanks’ with $188 million capital base would be sufficiently muscled to rub shoulders with banks from other better endowed markets. The truth, however, is that a bank with a capital base of below $200 million dollars may just qualify as a ‘mushroom’ size bank in developed money markets abroad. The possibility of collaboration between our local $188 million banks may still not qualify them for the third division in international money markets!

The government NEEDS programme, as conceived by a team headed by the current governor of the CBN incorporates a sliding naira rate in its projections over the near future. In this event, we may anticipate a fall in the value of the naira to about N250 to a dollar. The government economic team has several times murmured about the naira being currently overvalued. They have insisted that its current value is bad for our exports! “Which exports do we have apart from crude oil?” we may ask. Oil demand is fortunately not also dependent on the value of the naira. Our economic administrators have also alluded to other currencies with exchange rates in excess of 1000 units to a dollar as more supportive of a prospering economy than the naira at its current rate.

Thus, a rate of N250 to a dollar may not be an unrealistic expectation given the mindset of the administrators of our economy. Indeed, the current oil windfall makes this expectation almost certain. The need to find naira cover for the conversion, from dollar to naira, of the additional revenue brought about by the unpredicted surge in prices of crude oil recently would ensure a massive injection of (liquid cash) – naira into the banking system when allocations are paid into the bank accounts of statutory beneficiaries. It is unlikely that the artificial restraint (not stability) currently enjoyed by the naira over the last six months or so at below N133 to a dollar will be able to withstand the sudden deluge of naira chasing dollars!

When this happens and the naira depreciates to about N250 to a dollar, what will become the net capital base of our N25 billion ‘international mushroom’ but local megabanks? Well, the capital base of these banks would have shrunk embarrassingly to just about $100 million. What happens then? Do we now have a new round of recapitalization? When will the cycle stop if the naira’s slide continues unhalted? That is the million-dollar question.

Does Larger Mean Stronger and Better?

The N25 billion CBN capitalisation directive to the banks, as earlier indicated is also borne of the expectation that the bigger banks would be more efficient and effective in delivering banking services, which will positively support and galvanize the economy. However, critics have maintained that larger banks don’t necessarily mean more efficient service delivery. They argue that if the banks cannot manage their current humble status, the larger banks create greater operational and administrative problems! “Bigger banks bigger headaches,” the cynics argue.

However, we recognise that the CBN had indicated a 13point agenda for the banking reformation exercise; it is possible that other elements in the programme would be specially fashioned to improve specific deficiencies, particularly in terms of strict adherence to CBN monetary guidelines and the regular provision of accurate information on day-to-day operations. It may not be out of place to consider resident CBN audit teams in critical positions in each bank! The resident CBN audit teams would, of course, be subject to a rotational programme between the banks to avoid undue intimacy and the possibility of compromising their positions.

Has the CBN Put the Cart Before the Horse?

So, until the CBN releases the 12 other weapons in its arsenal, we cannot make any conclusive judgment on what effect the N25 billion capitalization directive would have on the improvement of the banking industry. What is clear, however, is that N25 billion or $188 million does not really make big banks especially when this net value could pale into insignificance on the likelihood further devaluation of the naira. It is also apparent that the CBN may have got its priorities out of context and may have inadvertently put the cart before the horse.

In this regard, the CBN may have been better advised to tackle the problem of the poor state of the naira as an option to the recapitalization directive. A naira rate of N10 to the dollar, would improve the erstwhile capital base requirement of N2 billion to $200 million. A capitalization requirement of N10 billion naira would translate to $1 billion dollar banks which can stand their ground against competition from other international money markets at a naira rate of N10 to the dollar.

Naira at N10 to the $: How Feasible?

The obvious question at this stage is how the naira can be made to exchange for, say, N10 to $1! The answer is simple: stop the monopolistic posturing of the CBN in the foreign exchange market. The same inadequacies of corruption, distorted pricing, lack of transparency, inefficiency, etc., which characterize all government monopolies also prevail in the foreign exchange market with one major supplier of over 80 percent of the available foreign exchange to multiple bidders; this is a monopoly in the same guise as the NNPC also monopolized the downstream sector of the oil industry until recently. NNPC monopoly has gone; the CBN stranglehold on the foreign exchange market through the Dutch Auction mechanism must also go for the Nigerian economy to right itself. The foreign exchange market must be completely deregulated; only then, in fact can the deregulation of the downstream oil market have desirable and salutary dividends.

Save the Naira, Save Nigeria!!!