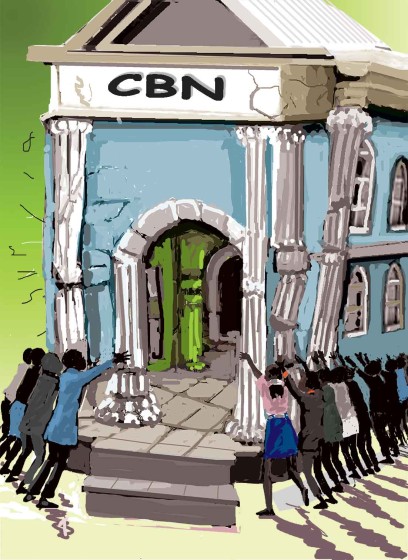

HOW THE CBN ENGINEERS POVERTY IN NIGERIA

By: Sir Henry Olujimi Boyo (Les Leba) first published in February 2005

INTRO:

Last week, this column republished ‘The Unresolved Burden of 5 Rates of Naira to the Dollar’ it explains the ‘mystery’ behind the Naira’s incapacity to appreciate despite increasing dollar reserves. If you missed this article, it can be found using the link below.

(See www.betternaijanow.com for this series and more articles by the Late Sir Henry Boyo)

Today’s republicationcomprises the feedback received from readers of this column in the year the referenced article “Will You Borrow Your Own Money and PayAt 17%...Ask CBN,”was first published. The article discussesreaders’ views,to which the Late Sir Henry (hale and hearty at the time), provided insightful responses to further engage the public on breaking the ‘self-inflicted’ cycle of poverty in Nigeria.

As you read through the below article taking note of previous events or rates, keep in mind its year of publication (2005), a clear indication that Nigeria’s economic situation is yet to improve even after all this time.

………………………………………………………………………………………………

This column will be devoted this week to feedback from two readers of ‘Rational Perspectives’. In addition, the anxieties and concerns expressed by our esteemed readers will also be briefly addressed. What is clear, so far, is the hunger of readers to find appropriate solutions to the serious economic problems which currently confront us as a nation. The answers given hereunder are not exhaustive but they provide a viable framework for rescuing us from the clutches of poverty in the face of increasing external reserves. You are invited to enjoy this piece.

RE: WILL YOU BORROW YOUR OWN MONEY AND PAY AT 17%... ASK CBN

(Rational Perspectives, Monday, December 27, 2004)

Dear Les,

First, I want to commend your insightful article. While I am not an economist (I'm an engineer), I do have some basic understanding of economics. However, your simple analysis of the issue really did shed some light and unless somebody comes with a better explanation as to why we continue this whole concept of the government issuing T-bills (as an instrument to mop out excess liquidity) at double digit figures really makes reason stand on its head.

If the government has 80% of the deposit in the banks, why is it basically borrowing from itself, and paying lip service to the issue of bringing down inflation? I suspect that it is another means of our lazy and corrupt elites stealing the nation blind! During the period I lived in the UK, I just couldn't help wishing the Nigerian interest rate would be like the UK banks’ which is set at a maximum of 1% above the Bank of England Repo rate. How in the world will Nigeria encourage big time manufacturers let alone small-scale entrepreneurs if the banks have an easy means of making 17% in a safe instrument like T-bills? No wonder the T-bills are over-subscribed.

In saner climes where there are political systems dependent on voters’ mandate, the CBN Governor and the Finance minister would be challenged by the opposition to a public debate to defend such practices that are anti-people and tantamount to economic sabotage!

Please keep up such enlightening articles. Hopefully, somebody would wake up to address this rip off that is keeping the nation in the vicious grip of perpetual under-development.

Best regards,

Mike A.

RE: WILL YOU BORROW YOUR OWN MONEY AND PAY AT 17% ...ASK CBN

Dear Mike,

Many thanks for your rejoinder to my piece in the Vanguard of 27/12/04. I have sought alternative or superior arguments for the past two years to my analysis, but sadly, I am yet to be provided with any of such. Indeed, a comprehensive paper was prepared by a colleague and I, and presented to the National Economic Intelligence Committee in Abuja in August 2002. They also could not fault the framework we proposed for revamping the economy. However, they appeared unhappy that we also sent copies of our paper directly to the Presidency as well as the CBN under Chief Sanusi when they did not make further contact with us as promised to support any sensitization programme. Both the current CBN Governor and the Minister for Finance have been in possession of copies of our paper for a year!

The Nigerian Institute for Social and Economic Research (NISER), however, considered our practical proposals as unconstitutional, while the CBN themselves through their Director of Research absolved themselves from policy making!

Our paper is titled: ‘A LIBERALIZED FOREIGN EXCHANGE MARKET: A Proposal for a Liberalized Foreign exchange Market in Nigeria and its Economic Benefits’. Please provide a contact address if you want a copy of this paper to be sent to you – of course, free of charge. Indeed, over a thousand copies have been provided to various stakeholders including select National Assembly Committees in the last two years!

Meanwhile, please confirm that I can use the content of your mail in one of my pieces in my Vanguard column – ‘Rational Perspectives’

Personally, I am resolved that only relentless prayer can touch the hearts of our leaders so that they can respond positively to ideas that will change our fortunes as a nation and liberate our people from the clutches of poverty.

Once more, thank you for your mail and God bless.

Yours, Les Leba

RE: WILL YOU BORROW YOUR OWN MONEY AND PAY AT 17% … ASK CBN

Dear Les,

Thanks for your response and the extra information provided as per the response of the various government agencies to your proposals. NISER's response is laughable. Pray, where in our constitution does it mandate government to borrow from itself and pay banks such percentage for doing nothing?

I believe the summary of the whole thing is as you rightfully put it - God's merciful intervention through prayer. In fact, daily my family and I raise up our voices to God in prayer for God to put honesty and the people's good in the hearts of our leaders.

Yes, you may go ahead and publish my response.

God bless and warm regards,

Mike (Email not disclosed to protect responder’s identity)

RE: UNRESOLVED BURDEN OF 5 RATES OF NAIRA TO THE DOLLAR

(Rational Perspectives, Monday, January 31, 2005)

Hello,

I enjoyed your piece. Whilst I share your desire for deregulation, I'm weary of

the to be Forex Traders in the country, I mean see what they are getting up to

in the Stock Market, I doubt the valuation of Share Prices most dealers put

forward. With this in mind I'm overly cautious on these same people dealing in

Forex, it is just too sensitive to be allowed. I mean anything that has to do with

market capitalism in Nigeria is overrun by market noise rather than any

tangible analysis.

However even if the market is truly deregulated, how would the value of the

Naira be derived?

An article in the Guardian suggested circa N45/$1! I didn't understand the

formula used though it was based on the division of a mean DAS valuation by

Purchase Power Parity.

Do you have any idea how forex dealers value the currencies they deal in?

Awaiting your response.

Thank you,

Anthony (Email not disclosed to protect responder’s identity)

RE: THE UNRESOLVED BURDEN OF 5 RATES OF NAIRA TO THE DOLLAR

Hello Tony,

Many thanks for your rejoinder to our piece on the “5 rates of the naira” published in last Monday’s edition of Vanguard Newspapers.

I appreciate your fears on deregulation given our past experiences especially with regard to the downstream sector of the petroleum industry.

The truth, however, is that deregulation of the downstream sector has failed largely because the 'cart was put before the horse'. The market for petroleum products cannot be effectively and appropriately deregulated without a prior deregulation of the foreign exchange market. (See an earlier piece in the Vanguard of 15th November 2004 "'The Mother and father of Fuel Prices' (copy attached). The proposals for effective liberalization of the foreign exchange market are contained in a paper" A Liberalized Foreign Exchange Market: a proposal for a Liberalized foreign exchange market in Nigeria and its economic benefits."

Please confirm if you need a copy of our 32-page proposal, which was first presented to the National Economic Intelligence Committee in August 2002. The Committee was unable to find faults with the practicable proposals but backed down from promoting its acceptance because we had impatiently also sent copies of the recommendations directly to the Presidency and the CBN Governor! Simply expressed, our proposal revolves around paying the states, local governments and other beneficiaries with registered dollar certificates (not cash) for the dollar component of federal revenue; the beneficiaries would seek to convert their non-negotiable dollar certificates to naira through commercial banks. The multiple holders of dollar certificates searching for ‘limited’ naira stocks would create a freer market that would supersede CBN’s current monopoly and attendant market distortions!

This arrangement would kill the ghost of excess liquidity, which has been the main stimulant of high interest rates, low-capacity utilization, endlessly depreciating naira and the need for the CBN to borrow back public sector funds at interest rates of over 15% via Treasury bill auctions.

In the worst analysis, the operations and effects of a liberalized foreign exchange market show much superiority to the archaic and retrogressive mechanism currently in adoption. Our naira would immediately gain value and industries would be resuscitated, employment opportunities will increase and poverty will recede.

You will agree that it makes little sense for banks to lend to the real sector with the attendant unavoidable risks when they could earn over 15% by lending back government funds to government in what is essentially a risk-free investment! One cannot ask for better terms from a trading partner! Don’t forget that the highest yielding stocks in our stock markets pay dividends often below 5% of the current share prices. If you were a commercial bank in Nigeria with the interest of your shareholders at heart, it is not difficult to identify what your best investment options will be under such scenario.

Thank you for your interest in the progress of our country, I will be glad to respond to any grey areas in our proposal.

Yours,

Les Leba.

RE : DEBT & SLAVER

I thank you for your mail in response to the article in our column ‘Rational Perspectives’ in the Vanguard of 28/2/05.

I thank you also for the suggestion of a third option akin to the current Argentinean approach. I agree that this approach should also be plausible; indeed, I recall that Nigeria had adopted a similar approach in the Abacha years with the debt buyback scheme, but you may recall the scam associated with its operation and the indictment of the then Minister for Finance and some heavy weights and members of the Abacha family with particular regard to debts owed to the Russian Consortium for the Ajaokuta Steel Project.

In any event, the Argentinean approach is applicable to government bonds rather than trade debts as in the Nigerian case. It is unlikely that our monetary authorities have the spine to imitate the Argentinean ‘debt swap’. They would find it more comfortable to go begging for debt forgiveness, even though grave doubts have been expressed about the genuineness of some of these debts.

In any event, most of our trade creditors see Nigeria as a big and rich giant who is not very bright upstairs; as the Sierra Leoneans would say “Na money Nigerian man get plenty, but he no get plenty sense” (Nigerians have money but no sense)- and they are unlikely to let go of their golden goose especially with the huge value of idle external reserves, which we currently have.

It is puzzling that our National Debt Management Office continues to raise their hands in bewilderment at the unrestrained and rising value of our national debt in spite of potential options which are available. Indeed, it is worrying that the debt management office is made up of people whom one would otherwise have described as enlightened men with fine intellect from a background of first-class educational institutions worldwide. I wonder!

Kindly discuss and introduce this and other articles in our column ‘Rational Perspectives’ to other interested friends and associates, who have the interest of Nigeria at heart.

Thank you for your mail and God bless.

Les Leba

Save the Naira, Save Nigeria!